Knowing Your Costs – Part 3: “The Present vs The Future”

As a proud member of the Rider Nation, and loyal fan of the entire CFL (despite the goofy new rules for

2015,) I witnessed something happen on the weekend that blew up social media and has fans of the

Green & White frothing.

The struggling winless Riders have been devastated by injury and lack-luster performances on field,

especially defensively. The order of the game plan each week seems to be “who can we plug where?”

One of the criticisms from fans is that there has been inadequate planning on behalf of management to

bring in the right new talent to provide appropriate solutions at time of crisis (like injury.)

While the business of football is a mystery to me, the business of business is not. Like a football team,

your business will face crises and you’ll need to adjust quickly. It doesn’t have to be personnel related

(like a football team;) it could be asset related (like equipment catastrophe) or market related (like a

major price decline) or anything. The knee-jerk reactions that are commonplace during times of crisis

rarely bode well for outcomes.

In the case of my favorite football team, the knee jerk reactions have been to sign different players to

the roster regularly. This is meant to fill the gaps left by injury, unsatisfactory performance, etc. This

knee-jerk reaction creates an air of constant uncertainty among the remaining players, and rarely brings

instant results because new players need time to learn the system, and gel with their teammates so as

to function as a unit when on the field. Wouldn’t it be better to have developed some younger players

and keep them on a practice roster? Players who would have learned the system since training camp,

and who are just itching to get on the field and show their stuff?

Similar to your business when you face crises, you could follow the lead of this football team and simply

run to the marketplace to buy another combine, rent more land, hire more people, apply more spray,

etc. The knee-jerk reaction would feel good in the short term because of the band-aid effect, but what

about the future? How has the knee-jerk decision affected your future profitability? Will the lease or

finance cost of that combine be affordable for the next 2-5 years? Will the extra land grow anything, or

will it be flooded out or ravaged with disease? Will your new hire fit in with your existing team and

culture? Will that extra spray increase or decrease your profit? Wouldn’t it be better to have given these

potential crises some consideration before the season started with some planning? With planning, you

would be prepared and then make a timely and informed decision. No more knee-jerk reactions.

The biggest issue with my favorite football team came to light during the last game this past Sunday. The

head coach pulled a young quarterback from the game after he threw an interception. The young QB,

who is 23 years old and fresh out of college, started the season as 3rd in line yet found himself in the #1

slot for the last number of games because of injury. By all accounts, this young man has the skills to be

the future leader of this team…in several years, not now. He needs time to learn, to enhance his skills

and his knowledge. The best way to enhance those skills is with real life experience. On Sunday, the

head coach regressed that young man’s growth by killing his confidence when he got benched for one

mistake. The coach made a knee-jerk decision that can, and likely will, have a detrimental effect on the

future of the team.

While the future of this football team weighs heavy on the fans enthusiasm right now, your business

doesn’t have to be this way. Whether it be a crisis in personnel, equipment, weather, or markets, the

preparation and planning you put in ahead of time will save you time, anxiety, and money.

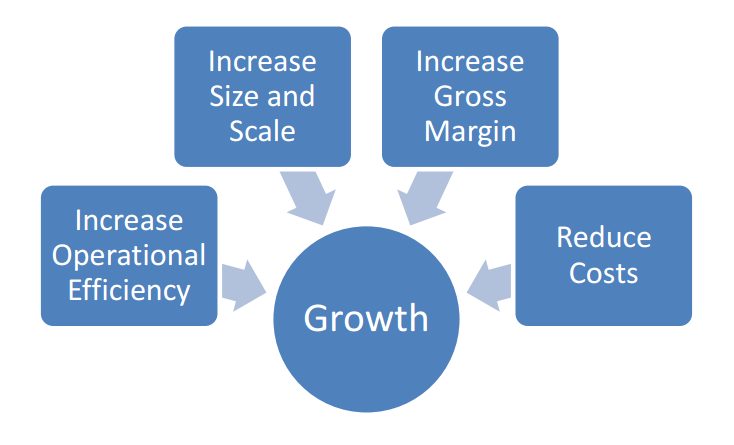

How does this relate to knowing your costs? It comes from planning. Knowing your critical crisis cost

points from investing time and effort in your management will clearly indicate where you have

sensitivities and where you have breathing room. The sensitive areas, where your return on investment

is tight, require more strategy analysis to better prepare for crisis.

Critical Crisis Cost Points

Personnel

o Key person quits mid-season (do you have a successor on the team today?)

o Injury, serious or minor (do you have a documented safety plan, insurance coverage?)

Equipment

o Does your current equipment cost per acre have room for an increase should there be

an equipment crisis?

o Is your current equipment line deficient or excessive based on your productivity,

efficiency, and cost expectations?

Weather

o Are you prepared for hail or frost, drought or flood? (i.e. do you have sufficient working

capital to handle the loss of gross margin?)

Markets

o Do you know your Unit Cost of Production so you can hedge for a profit?

Direct Questions

What have you done to prepare for crisis on your farm? Will you be making a prepared and informed

decision or a knee-jerk reaction?

What are you doing to understand your costs on your critical cost points to accelerate your ability to

make informed decisions during times of crisis?

From the Home Quarter

The planning that goes into putting together a successful football season resembles the planning it takes

to put together a successful growing season on your farm. You put together the best game plan you can

based on the assets at your disposal, tangible or intangible. You prepare for quandary by building depth

into your game plan for your critical crisis cost points. Sometimes you best plans aren’t enough;

sometimes the dilemma is greater than you could predict or the results are more damaging than you

could imagine. No matter how you slice it, your best bet is planning and being prepared by drawing the

distinction between risking your future on a quick decision in the present, or taking the charted path

keeping the long term success of your business always in mind.

The head coach of the Riders got fired before I could finish writing this article. I expect it was partly

because he refused to take any accountability for the team’s struggles. He routinely made decisions in

the present with a lack of regard for his, or his team’s, future. He arrogantly stated in interviews that

he’s a great coach and will find work if he’s let go. His unwillingness to look within himself as the leader

ultimately cost him his job. As the leader of your farm, please don’t get caught in that same syndrome.

Your future depends on it.