The Uncontrollables

There are many factors at play which affect your business each day. (Oh, look…I’m a poet and didn’t even know it.)

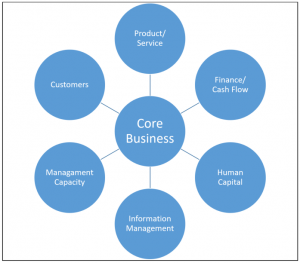

How is your business affected by:

- NAFTA

- Trade Wars

- Real Wars

- Geopolitical strife

- Interest Rates

- Income Tax

- Sales Tax

- Foreign Exchange

- Oil Prices

- Commodity Prices

- Utility Prices

- Inflation

- Deflation

- Theft and Vandalism

- Weather and Natural Disasters

- The 4 D’s (Death, Divorce, Disagreement, Disability)

- Physical, Emotional, Spiritual, and Mental Health

You have full control over none of these. At best, you might have partial influence over two or three on that list. Yet you, your business, and ultimately your family will all feel an effect that falls somewhere between minimal and profound.

The way to minimize the negative effect of any of The Uncontrollables is to prepare. You wouldn’t head out on a road trip with an empty fuel tank and no spare tire, would you?

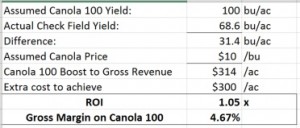

A strong balance sheet (meaning low Debt to Equity along with surplus Working Capital) will mitigate the negative effects of The Uncontrollables. Conducting sensitivity analyses on the likes of tariffs, interest rate changes, tax changes, and foreign exchange will provide your business with the critical knowledge needed to make informed decisions in the face of The Uncontrollables.

Plan for Prosperity

We can scream and holler, protest, or pout all we like in the face of The Uncontrollables; it will change nothing.

God grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference.

-Reinhold Niebuhr

Having the wisdom to know the difference between between what you can control and what you can’t is merely the fist step; acknowledgement of what you cannot control on its own will not mitigate the effect of The Uncontrollables. Action will trump intention every time.

Take action to protect your business, your family, your legacy. You need not be a rudderless vessel helplessly surviving on the mercy of the sea. There is no need to be stranded on the side of the road with no fuel, no spare tire, and no phone.

It took me until the next morning to be able to gather any sort of rational thought. The realization that so many families would be more profoundly affected than most any of us can imagine can take some time to sink in.

It took me until the next morning to be able to gather any sort of rational thought. The realization that so many families would be more profoundly affected than most any of us can imagine can take some time to sink in.