Balanced View of the Balance Sheet

Like any piece of business information, the balance sheet is only as useful as the quality and accuracy of the information presented in it. In my experience, the balance sheet either gets too much emphasis or not enough. Too much when a business is not profitable, but always falls back on “Well we (they) have strong equity.” Too little when a young business is in high growth phase and is focused on nothing more than the next expansion opportunity, usually at all costs.

The construction of a balance sheet is quite simple: assets on the left, liabilities plus owner’s equity on the right. As the name implies, the two sides must balance. So when liabilities are greater than the assets, there is negative equity. Yes, you can have negative equity, but not for long unless you have an incredibly patient banker.

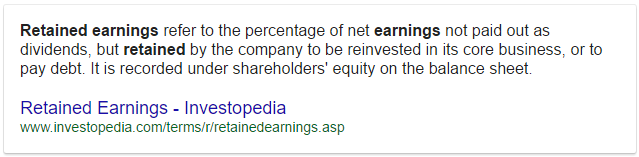

When describing the instances above where the balance sheet gets too much emphasis, the focus is clearly on the bottom half of the balance sheet, specifically the long term assets & long term liabilities and the owner’s equity. The equity is usually provided by appreciation of long term business assets, and if the equity is built almost solely on that and not retained earnings (net profit from operations) then there is definitely too much emphasis put on the bottom half of the balance sheet, namely equity.

The top half of the balance sheet is where most of the trouble starts. The top half is where we find the current assets and current liabilities; the difference between the two is working capital. Current liabilities have grown to dangerous levels from ever increasing loan and lease payments, cash advances, and trade credit. When current liabilities exceed current assets, you have negative working capital.

If your balance sheet has negative equity and negative working capital, you are the definition of insolvent, and the next phone you make is likely 1-800-AUCTION.

Ok, so there is equity on your balance sheet, more than enough to cover off the negative working capital. A patient and understanding lender might be willing to help you tap into that equity to “recapitalize” the business. Do that once if you need to. By the time you’ve gone to that well two or three times, you’re likely closer to needing the classifieds to find a job rather than the next deal on equipment.

Equity doesn’t pay bills. Cash does.

Why punish your cash and working capital by rushing debt repayment to create equity?

Plan for Prosperity

The next time you catch yourself, or anyone else for that matter, leaning hard on the bottom of the balance sheet, namely the equity portion, think long and hard about why the focus is not balanced between the top half and bottom half of the balance sheet.

Not only do the left and right sides of the balance sheet need to balance, but so does the top and bottom.