Recession Readiness

Recessions happen. In cyclical industries, the effect of a recession on a business’ results is magnified similar to how the benefits of a market boom are magnified. Industries that are less cyclical do not experience such swings in results and therefore appear to be more stable. These industries are less elastic (think about grocery stores, gas stations, natural gas companies) and are even considered “recession proof.”

If your business isn’t recession proof, here are a few tips to help you mitigate the effects of a recession and survive the downturn…maybe even thrive during it.

Bullet Proof Your Balance Sheet

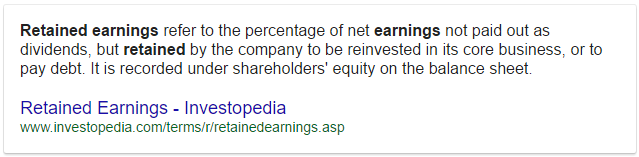

A strong balance sheet is your best weapon in fighting the effects of a recession. This also means keeping balance in the balance sheet, specifically top vs bottom, not just (left side and right side) assets vs liabilities. Top vs bottom means focusing on current assets and current liabilities (I.E. your working capital -the top half of the balance sheet), and not just accumulating assets and equity (the bottom half of the balance sheet.) Too often, I’ve seen businesses punish their working capital in a race to retire long term debt. While creating that equity by reducing debt is great, if it costs you your strength in working capital, it isn’t making your balance sheet bullet proof. Bullet proof is strong equity AND abundant working capital.

“Bullet proof your balance sheet during the good times, so you can catapult ahead of your competitors during the bad times.

If you get greedy during the good times, you’ll likely be on your knees in the bad times.”

– Moe Russell

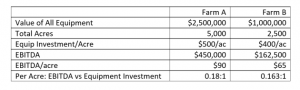

Trim the Fat

Where in your business have things gotten a little complacent? Where is your business over-equipped? What can be identified in your business as “nice to have” instead of “need to have”?

When business is good it becomes easy to let things slide, to acquire equipment that helps things along but isn’t necessary overall, to treat oneself in ways that weren’t affordable before. It’s human nature, it happens, but it’s not sustainable in business that faces recession.

It is the business owner’s/manager’s obligation to scrutinize assets and processes for opportunities to get lean. And getting lean BEFORE the recession, before the business is forced to make reductions, is far easier than when the situation has become dire.

Is making a change to diet and exercise easier and more beneficial before a heart attack (I.E. prevention) or after (I.E. recovery)?

Be Responsive

We’ve all heard it before, and have probably said it a time or two ourselves: things will get better, they’ll turn around, just give it time.

Famous last words?

No one can accurately and consistently predict how long the market cycles will last. Many think they can, but they can’t. So if your business generates results that do not meet expectations, doing nothing about it is sure to repeat the same results. How long can your business not meet expectations during a recession? If we knew how long the recession would last, we could answer that question confidently, but we already acknowledged our inability to prognosticate market cycle duration. The solution then becomes, “do something about it.”

If revenue was below target, find out why.

If profit missed expectations, find out why.

If your best employees have resigned unexpectedly, find out why.

Waiting for divine intervention to “turn things around” is rarely a successful plan.

Plan for Prosperity

The advice above does not only apply to preparing for an economic or market recession; it applies to big picture planning in your business as well. Because it doesn’t take macroeconomic factors to have an impact on your business, putting these actions in play anytime will prepare you and your business for the unforeseen hazards that can throw your best laid plans into the ditch.

If you want to “Be Better™” is starts with “being ready.”