Managed Risk – Part 4: Liquidity

We’ve all heard the saying “Cash is King.” In my opinion, “cash isn’t king, it’s the

ACE!” Whatever metaphor you prefer, the point is that cash levels and cash flow are both critically

important to your business. So, let’s get right to four points that affect your liquidity:

1. Your view of cash.

When I was still farming, I asked dad when he wanted to receive his rent payment, now (at the

time it was late November) or after January 1. He replied, “Well, I wouldn’t mind seeing a bump

in my bank account now, but I’ll wait until January for income tax purposes. Why?” When I

admitted that at that time we had no cash and would be dipping into our operating line of

credit, he said, “I thought you said your farm was profitable.” Our farm was profitable. He

couldn’t wrap his head around the fact that a profitable farm might not have cash always at the

ready, especially a small farm still in its youth. He equated profit with cash in the bank. After

arguing the point for 5 minutes, he just shook his head saying, “I guess that why I’m not farming

any more, I just can’t take that much risk.”

What he was getting at with his final comment was how we very quickly allocated our cash that

year. With harvest sales, we cleared up all accounts payable, pre-bought some fertilizer, and

paid down our supplier credit. The bins were still full, and with more grain sales scheduled for

the weeks and months ahead, our working capital was strong.

What is the difference between cash on hand and working capital? (HINT: if your answer is

“nothing,” then think again, a little deeper this time.)

2. Your use of cash.

Over the last few years, how many new pickup trucks were paid for out of working cash or put

on the operating line of credit? This is one example of a poor use of cash. A business that is flush

with cash can be a dangerous thing in the wrong hands, but don’t fret because the laundry list of

vendors all clamoring for your money will offer plenty of opportunity for you to part with it.

Do you justify some of these types of expenditures as part of a “tax plan?”

3. Your timing of cash.

One of the major challenges for manufacturing companies is the “cash conversion cycle.” This is

the time it takes to convert raw materials into cash. This cycle happens frequently in a

manufacturing firms operating period, often several times each month or quarter (depending on

what they are manufacturing.) Your challenge in the business of farming is that you only get one

cash conversion cycle per year. You invest in inputs early, manage through a long production

cycle, only getting one chance at producing the crop that will be sold for cash, and eventually

selling it sometimes as late as half way through your next production cycle. It is this long cash

conversion cycle that makes cash management vitally important on your farm.

How long is your farm’s cash conversion cycle? (HINT: it is measured in days.)

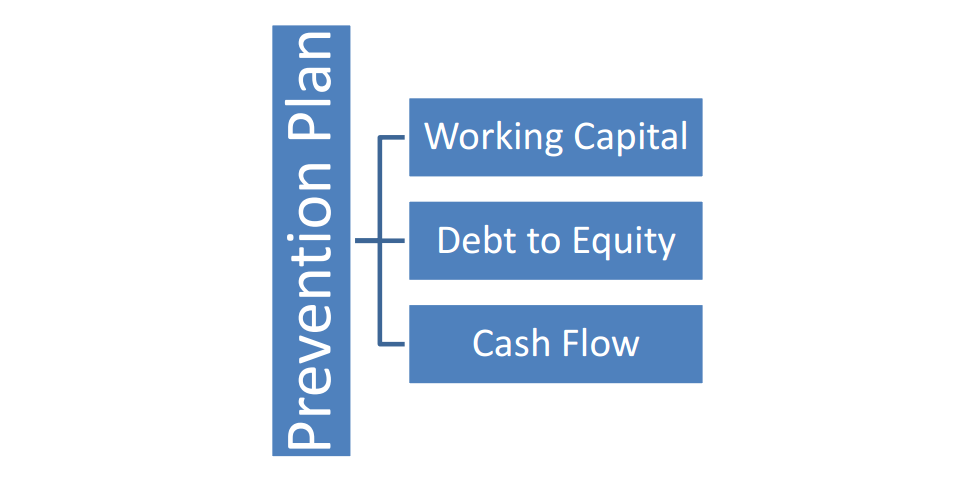

4. Managing your liquidity.

Working capital is a component of your liquidity. Measured as the difference between current

assets and current liabilities, your level of working capital is a direct indication of your business’

ability to fund its current operations. This, or course, is critically important to your lenders.

The desire to utilize easy credit and therefore finance everything from combine belts to

hydraulic oil may sound like a simple way to keep the wheels turning. If your farm is without

cash due to poor crops/pricing/etc. from the previous year, then available credit is a lifesaver to

help you keep operating. Just remember, such a scenario is a short term solution, and by no

means can it be considered a long term strategy. Sooner or later, your creditors will tire of

holding all the risk of funding your operations. Your working capital must be built and

maintained.

How much working capital is appropriate for your farm? (HINT: it’s probably more than you

think.)

Direct Questions

How do you view cash? Does it only have value when allocated (spent,) or is it an essential asset on the

balance sheet?

If you believe cash in the bank is an indication of profitability, can you not save your way to increased

profit?

How would you describe the financing cost to your business relative to the long cash conversion cycle

and the cost of credit?

From the Home Quarter

I had heard a seasoned old banker years ago say how “farmers don’t like to have money in the bank,

because as soon as it gets there, they spend it!” When there is cash in the bank, we feel profitable, and

often the decision is to allocate that cash to another asset. Will that other asset help repay liabilities?

For as long as I can recall, this industry has always dubbed itself “asset rich & cash poor;” the push

among players has been to build equity. And while the chase for equity is noble, equity does not pay the

bills, nor does it make loan payments, nor does it meet payroll. Cash does.

We must make cash management an utmost priority. If we are relying on financing for most/all of our

daily operations (operating credit,) what will happen if/when a lender does not renew those lines of

credit? Do you recall the ruckus out of the US each time they need to “raise the debt ceiling?”

Potentially, all government operations would get shut down. Same goes for your farm. If you have no

cash, and your credit lines get called, what are your options? I can tell you, they aren’t pretty.

It does not matter whether you believe “Cash is King,” or “Cash is the Ace.” If you have neither, you

might be forced to fold.