Control

Happy New Year! My wish for your 2017, as I’ve extended to everyone regularly so far, is “peace and prosperity.” That may have been fortuitous as this, the first weekly commentary of 2017, carries a new name: Pragmatic Prosperity™.

Prosperity is not only my hope for the entire agriculture industry, it is my goal for every business I work with. Pragmatic describes the advice, strategy, and solutions we bring to each engagement. We are very excited about this evolution in our branding.

How do you employ control in your business? Is it over operations, people, cash flow? Those are quite broad descriptors, and when it comes to people, please recognize the difference between control and influence.

Here are the top areas to control in 2017 to achieve greater prosperity.

- Cash

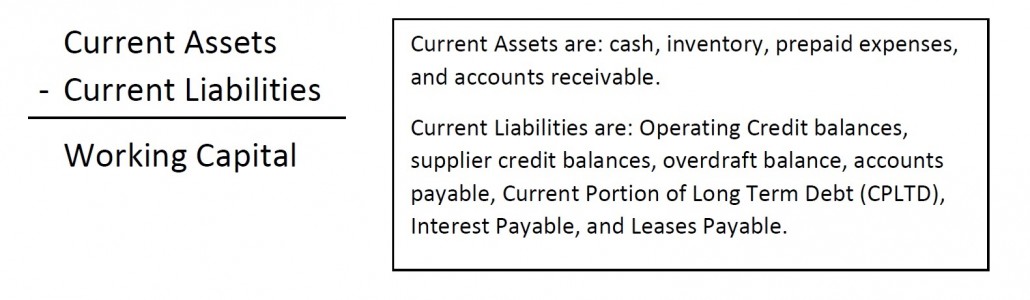

Working capital, especially cash, is a critical component of any successful business. Over the life of this weekly blog, you’ve read my constant rant about improving working capital. More and more important, the piece of working capital that needs focus, will be cash. A big part of working capital is inventory, but in a time when it is all too common for inventory to fall subject to grading issues, delivery glitches, etc, farms need the stability that comes from increased cash on hand.Expenses and debts unabashedly punish your cash. What are you doing to protect it? - Marketing

Even though we’ve had (generally) another banner year on the crop side, we have to give credit to the insulation from the commodity slide that we’ve enjoyed thanks to our slumping Canadian Dollar. Should the dollar strengthen, we’ll feel more of the pinch that our American neighbors are living with today. How would your cash flow look if you had to manage today’s expenses with 2010 prices?

Far too many farms rely only on forward contracts. The reasons for it, I won’t speculate. Many tools and advisors exist to help you control your marketing (versus letting your marketing control you.) When you’ve got full control over operating expenses (Point #3 below…keep reading) your marketing opportunities become more clear. This allows you to confidently price profitably. - Operating Costs

When we make more, we spend more (despite a contrarian strategy discussed here on May 17, 2016 – Spending Less is More Valuable than Earning More.) As farm incomes rose, so did farm expenses; what used to be “nice to have but could live without” has now become “must have” (in mindset anyway.) If we are to compare 2017 expenses to 2010 income (as suggested above,) why not look at 2010 expenses too? How have operating costs changed in your business over the last 7 years (2010 to 2016 inclusive)?

To Plan for Prosperity

You’ll note that the first item listed, cash, is at the top for a reason. However, if you start at the bottom, you’ll see how it is connected, how it flows and will get you to the results you desire, the results you may not think are achievable…but most certainly are.

Start with 3, it will have great impact on 2, which will lead to strength in 1. Control them all as you would control your equipment.

Make sense?

3…2…1…GO!