New Tech and its ROI

“It wasn’t until 1954 that tractors finally outnumbered horses on prairie farms.”

I learned this interesting factoid from Steve Leibel from FCC’s Management Software division when he

spoke to our local CAFA chapter in Regina earlier this spring. The presentation was on technology, not

economics, so we didn’t examine why it took so long.

Maybe that wasn’t a long time for farmers to adopt the technology of mechanized horsepower versus

literal horse power, but I think it was.

Today, it’s a little different; we adopt technology almost as fast as it can be released. I find that even my

head sometimes spins at the advances of new technology, so I can’t imagine what my grandfather, who

broke land behind a team of oxen, might think.

Much of this technology provides an incredible economic benefit. Others only provide marginal

economic benefit. Who has done the math before investing?

Shouldn’t any investment provide positive return to your farm? Of course it should, but not only should

it provide a positive return, there should be a threshold for that return to meet as well. Surely anything

that provides less than 2% ROI is better off staying on the shelf in favour of a risk free investment. This,

of course, is an extreme example notwithstanding those investment that provide negative ROI.

This winter I listened to Lance Stockbrugger say, “I love technology as much as anyone, but if it doesn’t

make me more money, what’s the point?” How much money do you need to make to invest in new

tech?

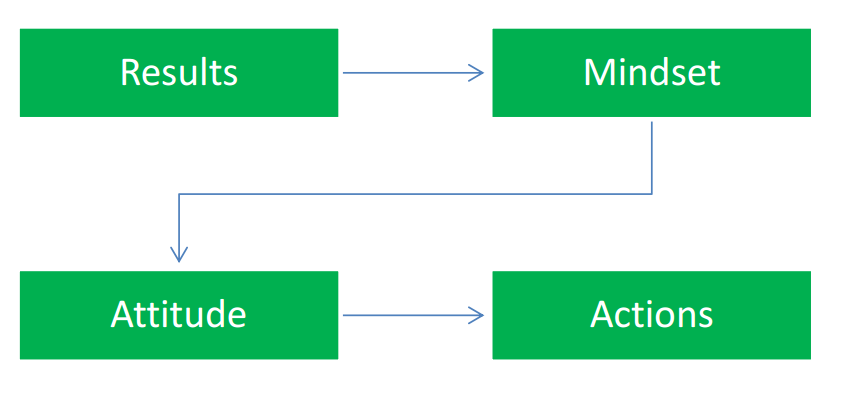

For some, there is no concern to the economic benefit of new technology; they just need to have it! For

skeptics, any proof of economic benefit is cast aside as nothing more than salesmanship.

ROI is a useful starting point for any investment. ROI is important to know because it not only indicates

the net benefit it will also offer insight into how long payback will take. Technology that offers 100% ROI

in the first year would “pay for itself”. Technology that offers an ROI greater than 100% in the first year

would pay for itself and provide positive cash flow above what would have been realized otherwise.

Technology with a 20% ROI would take 5 years to pay back your investment.

So let’s ask again, “How much money do you need to make to invest in new tech?” This also applies to

land, equipment, people, and professional services.

Direct Questions

How do you determine if an investment of your capital is worthwhile?

What is an appropriate ROI for different investment options?

How do you measure the success or failure of your decisions of how & where to invest your capital?

From the Home Quarter

Land investors want 3-7% annual ROI on their investment. Employees should be able to return 200% ROI

(their wage or salary times two) to their employer. What about iron, gizmos, gadgets, etc? Some of this

can be hard to measure: what was the ROI on hopper bins when they first came to market? While it can

be done, it’s not easy to put a financial value on efficiency, safety, and convenience, but those factors

certainly provide an intangible ROI.

I enjoy seeing the increase in confidence that my clients enjoy after we go through an ROI exercise as

they determine how to invest their capital. Reviewing realistic numbers to project the financial benefit

takes the emotion out of the decision.

I bet that early 20th century farmers didn’t do an ROI calculation on having a tractor on their farm versus

horses because if they did, I’d say that tractors would have outnumbered horses a lot earlier.

If you’d like help determining ROI opportunities on your farm, then call me or send an email.