Critical State – Maintaining Inadequate Working Captial

I’ve gone on record many times saying that I believe that the lack of adequate working capital at the farmgate presents the greatest single risk to the future of many farm businesses.

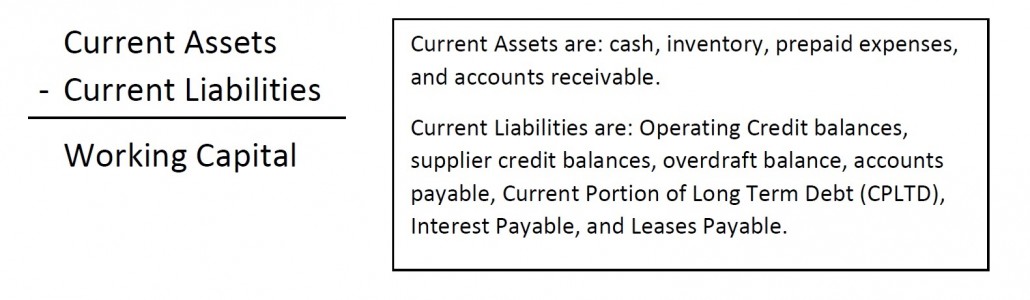

Working Capital is calculated by subtracting your current liabilities from your current assets.

It is important to calculate working capital correctly, not only to satisfy the requirements of your creditors, but for your own management information as well. Overstating your working capital will give false confidence. Understating your working capital could cause you to unnecessarily inject capital into the business, or to miss out on taking advantage of business opportunities.

Maintaining inadequate working capital carries many risks, both direct and indirect, such as:

- Relying on operating credit and trade (supplier) credit.

Heavy, or total, reliance on outside credit to provide access to the capital necessary to run your farm is as great a danger as a reckless crop rotation. There is no guarantee that these credit vehicles will continue to be available in the future as they were in the past. How will the crop get seeded next year if there is no working capital, and no operating credit, available? - Using debt to pay debt.

Many businesses have plead their case by illustrating that the debt payments were always made on time. What they failed to recognize was that the debt payments made were sourced from an operating line of credit, and therefore using debt to pay debt. - Loss of profit potential.

By leaning on outside credit, many farmers are forced to sell grain when they need cash to make payments, revolve credit lines, etc. instead of selling grain at a point of opportune profit. Selling grain when you have to instead of when you want to can mean the difference between profit and loss.

In regards to building and protecting working capital, here are just a few of the tactics I offer:

- Know your Unit Cost of Production.

This goes beyond crop inputs. It includes ALL costs to run the farm from fuel, to insurance premiums, to paperclips for the office. Knowing UnitCOP allows you to clearly understand where your profit is made. - Stretch loan and lease amortization periods.

Interest rates are low, and recently there are hints that it might go lower yet. Stretching your payback period allows you to enjoy making lower payments. This is especially helpful in a year when cash flow & profitability will be tight. Accelerate payments in years when cash is abundant. - Plan with Strategy; Discipline in Tactics.

Far too often, we see businesses that operate without a plan by simply focusing year over year on operations (getting the work done) and as such, most decisions are made in reaction to a need or want. By building a clear & well-thought out plan, decisions become proactive when employing discipline through the execution of the plan. Deviating from the plan (IE. a great deal on a new pickup!) can jeopardize working capital and future profitability.

Direct Questions

How often do you calculate your working capital? (HINT: it should be monthly at a minimum)

What is your minimum level of working capital to have available? (HINT: it should be 50%-100% of your annual cash costs)

What is your strategy to increase and maintain adequate working capital?

From the Home Quarter

Inadequate working capital causes business owners and managers to make decisions they otherwise wouldn’t. It forces their hand. It takes away their control.

Abundant working capital creates opportunity, allows flexibility, and puts control of the business in the owner’s and/or manager’s hands.

Critical State can be only a breath away when working capital is inadequate.