Super Bowl Management Quality

They should have seen it coming.

Didn’t some pundit declare something like a 99.9% chance of a Falcons victory with about 8 minutes left in the game? Somebody please clarify if that was actually the case.

A rather pompous thought that I kept to myself while watching Super Bowl LI, after Atlanta took a 28-3 lead, was “Brady’s just smiling at the bigger point differential that he’ll get to cover on his way to a win.” In hindsight, that comment would have been brilliant…had I actually said it.

They should have seen it coming.

Yes, it is easy to prognosticate in hindsight, but that’s not the point here. What did it take, what did the New England Patriots do to win another championship, aside from setting 24 new Super Bowl records and tying 7 others?

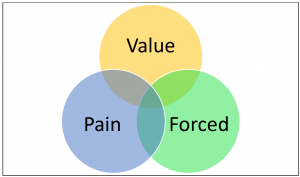

- People

Bill Belichick has been the head coach of the New England Patriots for 17 seasons. He is in the top 5 winningest coaches in NFL history.

Tom Brady has virtually cemented his place as the NFL’s greatest quarterback of all time. Based on the last 17 years of performance, he was a steal in the 2000 NFL draft, going in the 6th round (199th)

The rest of the team contains very few “superstars,” yet when their superstar QB was suspended for 4 games to start this season, the team went 3-1. - Management

This starts at the top with vision. In the five seasons before Robert Kraft bought the franchise in 1994, the team was 19-61 (a .238 winning percentage). In 1994, the team made the playoffs, and did so 4 of the first 5 years under Kraft’s ownership.

Management’s plan clearly put great emphasis on people. Since Kraft took ownership, the team has only had 3 head coaches, with Belichick, the current head coach, being in place for 17 of 24 seasons of Kraft ownership. The team is part of a privately owned family enterprise. - System

What words could you come up with to describe the system that has propelled, and maintained, team success for so many years, including the greatest comeback in Super Bowl history? Many had felt that the game was over at half-time: no team has ever come back to win the Super Bowl from more than 10 points down, Atlanta was dominating both sides of the ball (offence and defense,) and New England was making mistakes (turnovers, dropped passes, missed kicks.) Yet, the Patriots found a way to win. They had a system, and stuck to it, never giving up, never quitting. It would have been easy to deviate from their system in the face of such adversity; it would have been easy to lose motivation under what was deemed to be an insurmountable deficit.

The New England Patriots are by all accounts a highly successful business. How does your business compare? Can you reach top decile?

People: do you have the right people in the right place? It does not matter if they are family members or not, evaluate everyone, even yourself.

Management: does your management team have a vision and a strategy to achieve results that would put you in the top 10% of comparable businesses?

System: have you developed systems that are proven to work year in and year out, providing you with dependable efficiency and results? Or is every year a new roll of the dice?

Management has a vision, they put the right people in place, and everyone executes the system.

To Plan for Prosperity

Set yourself up for success. Model your business, and your approach to business, after other successful enterprises. We may not be New England Patriots fans because we envy their consistent competitiveness and success, similar to how we may not be oozing with adoration for the most successful farms in our area, but doesn’t that make them a great model to follow?

For the record, I’m not a Patriots fan, I am (at best) a casual NFL fan. I was actually hoping Atlanta would win Super Bowl LI (for no specific reason,) but I’m not disappointed with the outcome; it makes for some great storylines and it forces everyone to admit some admiration for an enterprise with the success rate of the New England Patriots.