BMP – Best Management Practices

BMP’s, or Best Management Practices, are also often referred to as “Best Practices.” Commonplace in

corporate culture, the primary benefit served by BMP’s is bringing consistency to methods or techniques

used to accomplish a task or objective. Also focusing on efficiency and ensuring the best use of available

resources, BMP’s are everywhere, even if they aren’t documented in a manual somewhere.

Your farm is no different. Over the years, you’ve likely established a BMP for the way in which you

service the combines in season. With good harvesting weather typically in short supply (especially this

year) you’ve got “a system” for how you deal with blowing out filters, cleaning windows, greasing,

fueling, and the circle check you do to identify trouble spots like belts, bearings, and chains. If, and

when, you have new employees on the farm, how do you convey your “system” to them?

Is it fair to say that the Best Management Practice you’ve worked out for servicing combines, for

example, isn’t available in an employee handbook, or even on a notepad somewhere? It’s in your head.

It’s just what you do. It’s habit. It’s automatic. It’s common sense.

What may be a common sense natural work flow to you might be as abstract as a foreign language to

your new helper, your spouse, or your kids.

You may have felt the same angst as your new helpers at harvest while listening to your banker describe

the nuances of your financing arrangement, or your lawyer discussing tax implications. It can feel like

they are speaking a different language.

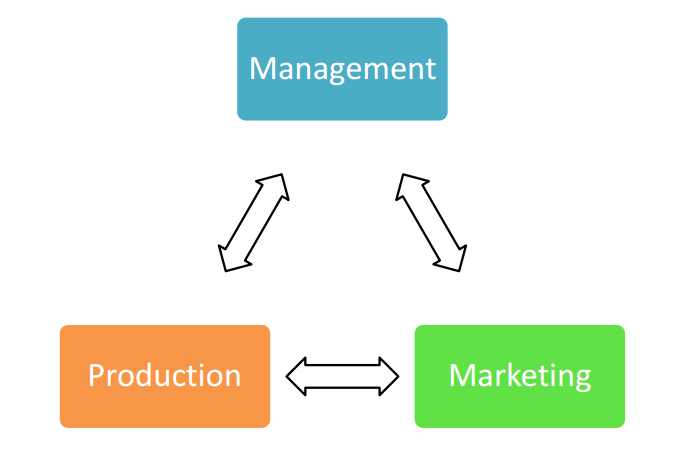

In your business, communication is the answer. Any best practices you have developed over time

(documented or not) are useless if not effectively communicated to the right people.

Best Management Practices apply to many aspects of your business, such as:

- Managing financial data

- Processing invoices

- Servicing equipment

- Soil conservation

- Employee engagement

- Etc.

This list is by no means exhaustive and could go on & on. There is likely a best practice you could think of

for just about everything in your business.

Direct Questions

How many specific Best Management Practices do you already have in place on your farm? How many

are documented?

How could your stress level be reduced in the busy season if you had BMP’s documented for new

helpers to review and be comfortable with prior to “trial by fire?”

It isn’t realistic to implement a BMP for every task on your farm, but what would it take to do so for the

most critical functions that take place through the course of a growing season?

From the Home Quarter

Best Management Practices are everywhere, they are all around you whether or not you see them, have

formalized them, or even give them a moment’s consideration. They have helped you expand, do more

with less, and streamline workflow. They are available in all aspects of your business, if you chose to

seek them out and implement them.

Over the winter, I will be spending time with each of my clients working on several issues, with one

being Best Management Practices. If you’re interested in learning more, please email me or call

anytime.