The Great Profitability Challenge of 2018

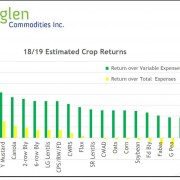

The graphic seen above was shared at a recent CAFA chapter meeting (Canadian Association of Farm Advisors) and forwarded to me by one of my fellow CAFA colleagues who was in attendance. By coming from a reputable commodity trading entity, there is a level of trust we can have in the data presented.

And the (projected) data looks bleak.

With only four crops expecting a net profit to exceed $50 per acre by any respectable amount, the profitable options for 2018 are few and far between. No wonder the common sentiment this winter is “I don’t know what to grow this year; doesn’t look like anything will make a profit.”

Considering the four crops in the Rayglen projection that are close to abundantly profitable are 1 variety of chickpeas and 3 varieties of mustard, it’s pretty clear that your geography becomes part of your challenge. Yes, wheat, barley, flax and canola are also projected to be positive, but are any of them sufficient based on the risk and/or your personal circumstances on your farm?

Here are some questions that I feel must be asked:

- Is crop rotation holding you back from loading up on what few profitable options are available?

I recently heard a lender suggest that those who blow up their crop plan to chase the perceived winner, by his account, usually miss out.

This can be often true because of the long cash conversion cycle in production agriculture. Farmers bet on a crop plan that they expect will make them money, but a lot can happen between February and harvest…the market giveth and the market taketh away! If there is one thing Western Canadian grain farmers can do, it’s produce! We can overproduce a commodity in as little as one crop cycle, and as such in July or August drive down what was a winning price back in February!

The lender referenced above went on to say that sticking to your proven crop plan is the way to hit a winner most years, maybe even multiple winners! - Is $50 per acre or even $75 per acre net profit realistic, or even sufficient?

How much was expected yield and/or price “padded” in that projection? How much were total costs “softened”? Were there 4-6 applications of fungicide built in to those chickpea projections?

Generalist type of prognostications like this one need to be taken with more than just a grain of salt. Do the “variable” and “total” expenses displayed reflect your farm? What is included in each category? Are they including all expenses, including the PAPERCLIPS? There is much ambiguity in figures like these. - Do whole farm expenses reflect the capability of the crop plan, or is the crop plan now expected to meet the ever-increasing farm expenses?

Recently, I’ve overheard a couple of pundits suggest that whole farm expenses are now nearing $400 per acre. If true, that relegates many crop plans into the underworld of “operating loss.” I’ve gone on record several times suggesting that the elongated commodity boom recently ended has allowed many bad habits to form at the farmgate. The habits in question surround the insatiable appetite for newer/bigger farm equipment, larger land base, and higher living standards. It wasn’t long ago that top tier farmers kept their operating costs (described by some as labor, power, & equipment) in the range of $90-$100/ac, and these pundits now suggest that the best of the best are in the $140-$150/ac range. That $50/ac increase in what is the most controllable facet of farm expenses clearly has shaken the profitability potential to its core on many farms. And that only applies to those whose operating costs have increased by ONLY $50…

Plan for Prosperity

The recipe for profitability is simple:

- Have a plan (how/why/what you do);

- Run lean;

- Know your numbers & market to your numbers;

- Maintain discipline.

Of course, if it was as simple to do as it is to describe, everyone would simply do it. Also, did you notice that nowhere was there anything in that recipe about production or farm size? In the commodity business, the winner is the one who produces at the lowest cost per unit of production; the best way to achieve that is to have a plan and maintain discipline to it, get lean and stay that way, and finally market your production to your numbers (not to your emotion.) If you’re have challenges with any of the four ingredients in that recipe, why haven’t you picked up the phone and called for help already?