Vision

Where are you looking?

As an entrepreneur, there are numerous issues clamoring for your attention. Which ones get your time and focus?

If your business is a vehicle hurtling down the highway, where are you sitting in the vehicle and where are you looking?

- Driver’s Seat

The now defunct automaker, Pontiac, once used the tag line “Built for Drivers.” Many years ago, a good friend owned a Pontiac Grand Prix. As I got in, and looked for the seat adjustments, I found that there were not many and they were manually controlled; whereas his driver’s seat had full power adjustment and more. As I poked fun at the lack of amenities in his car, he casually fired back, “Built for drivers.”

The driver’s seat is command central. There is little that cannot be controlled from the driver’s seat, and practically nothing can be controlled elsewhere which is not controllable from the driver’s seat. The control is centered here.

In your business, the metaphor of the driver’s seat is not just a seat for one (I am sure you do not want a culture of autocracy in your business). With whom are you sharing control? Do you all have the same goal for where the business is going, or are you all tugging at the wheel trying to change direction, arguing over heat versus air conditioning, or fiddling with the radio?

Maybe you are sitting in the passenger seat, providing navigation assistance and influencing the decisions of those in the driver’s seat? Just be aware that if you are in the passenger seat, it takes a more concerted effort to see what the driver sees. Read on… - Dashboard

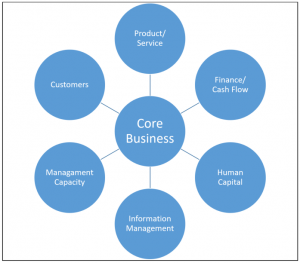

The more comprehensive the dashboard, the better. Personally, I am highly frustrated at vehicle dashboards that have only three gauges and a plethora of warning lights. By the time any of those warning lights appear, it’s too late, the damage has been done. Whereas a a dashboard full of gauges allows me to monitor all the critical functions of my vehicle (my business.) My ideal dashboard looks more like this photo.

The more comprehensive the dashboard, the better. Personally, I am highly frustrated at vehicle dashboards that have only three gauges and a plethora of warning lights. By the time any of those warning lights appear, it’s too late, the damage has been done. Whereas a a dashboard full of gauges allows me to monitor all the critical functions of my vehicle (my business.) My ideal dashboard looks more like this photo.

Are you looking at your dashboard? Is your dashboard full of gauges or warning lights? If you have ignored the gauges, you will still get a warning light (and possibly an alarm) indicating your working capital is depleted, your staff is unproductive (maybe even leaving your employ), or your overhead has gotten out of control. These alarms could come from your banker, your key managers, or your accountant. But once the alarm has sounded, is it too late? It is much easier to proactively respond to an overheating engine by watching the gauge on the dashboard rather than getting an alarm telling you “it’s too late, now pull over and stop.” - Rear View Mirror

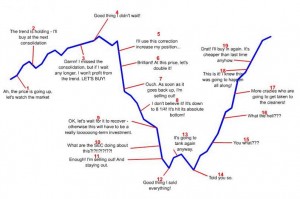

While most drivers fail to look in their rear view mirror enough, entrepreneurs tend to look there too much. While it is human nature that our past experiences shape our future decisions, it is impossible to move forward if you are only looking back. (Notwithstanding, I continue to be amazed at how many drivers do not look back, even when their vehicle is in reverse!)

Take a look back regularly. Acknowledge the decisions that created the path left behind. Learn from them. Make better decisions going forward. - Out the Windshield

New drivers tend to look down the hood of their vehicle at the road immediately in front of them. By doing so, they often fail to recognize a hazard up ahead. This practice can result in severe reaction to avoid a hazard which may put the vehicle out of control which may result to a collision, injury, or worse.

New entrepreneurs often have the same behavior: they tend to look only at what is immediately in front of them. Like the new driver, this can result in extreme adjustments from a reaction to avoid a hazard whether perceived or real. Does this apply only to new entrepreneurs? Sadly, no.

By keeping your eyes up and on the road ahead, the driver can identify potential hazards early and adjust strategically. She can scan the landscape to the left and right for wildlife and intersecting traffic. Doing so allows her to be prepared to respond quickly and accurately versus panicked and severely.

Plan for Prosperity

Whether you sit in the driver’s seat or the passenger’s seat, you have the best perspective to see what is ahead. Discuss the observation and decide how to respond. (Vision/Strategy)

There is a reason the rear view mirror is a fraction of the size of the windshield. Use each of them accordingly. (Progress)

Build yourself a dashboard that allows you to quickly and easily monitor the most critical functions at a glance. This dashboard information is only useful if current and accurate. (Monitor & Control)

Where are you looking?

It took me until the next morning to be able to gather any sort of rational thought. The realization that so many families would be more profoundly affected than most any of us can imagine can take some time to sink in.

It took me until the next morning to be able to gather any sort of rational thought. The realization that so many families would be more profoundly affected than most any of us can imagine can take some time to sink in.