Managed Risk Part 2 – Interest Rates

In a conversation recently with a young farmer, who I feel is a poster boy for excellent business

management, he disclosed that he’s far more concerned with rising interest rates than low commodity

prices. During our brief exchange on this topic, I stuck with my position that interest rates, if they move

up at all, will see modest increases because when we consider the volume of credit currently

outstanding, the effect (desired or not) of any increases would be dramatically slower spending and

investment. Currently, I see no reason domestically to raise interest rates. His position involved a

number of macroeconomic factors including China, the US, and the EU. Admittedly, I’m less fluent in

how China’s recession will affect the Bank of Canada’s prime rate or how it will trickle down to Canadian

agriculture, specifically primary producers, but no doubt there is an impact to consider.

Just because the Bank of Canada may not be raising its prime rate does not mean that lenders won’t

raise theirs. The Bank of Canada prime and the chartered bank’s prime are related, but not directly

connected. The Bank of Canada makes its decisions on economic factors. Lenders make their decisions

based on business factors and their expectation of a profit. Lenders most likely recognize that increasing

rates now would be harmful, but again they have profit expectations and dividends to pay.

Is your business the same? Do you have a profit expectation and dividends to pay to shareholders?

It was encouraged in Growing Farm Profits Weekly #11 on March 17, 2015 for everyone to do an

interest rate sensitivity calculation. I would enjoy hearing from readers who did an interest rate

sensitivity to understand what they learned from the exercise. For those of you who didn’t do one, here

are some points to ponder:

- Interest costs on term credits are controllable only at the time you sign documents, or at

renewal. - History shows that over the long term, floating interest rates are cheaper than fixed rates.

- While enjoying the consistency that fixed rates offer, consider the ramifications of renewing all

your fixed rates at the same time. Having no control over, nor any idea of, what future interest

rates will be, what is your strategy to manage this risk?

HINT: it’s something you climb, but it isn’t a tree. Call or email if you want to explore further. - The interest rate you pay to your lender is a direct representation of 2 factors:

- The cost incurred by the lender to acquire the funds being lent to you, and

- Your lender’s view of how risky your particular business is. IE: you might pay more or less interest

than your neighbor if the lender views your farm as being more or less risky than your neighbor’s farm.

(This is the significance of knowing what’s important to your lender!)

- Competition for business is the 3rd factor affecting your interest rate – and it goes both ways.

At the end of the day, your control is over how much you borrow, and for what purpose. Bad debt is

unhealthy enough, but interest on bad debt is worse. Your interest strategy needs a blend of fixed and

floating rates, varying terms, and payment dates that align with your cash flow.

Direct Questions

Consider the pros and cons for each of “blended payments” and “fixed principal plus interest

payments.” Which payment structure best fits your needs?

When doing an interest rate sensitivity test, do the results scare your socks off?

What is your strategy for managing loan interest?

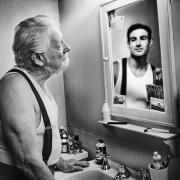

From the Home Quarter

The great equalizer across all farms is Mother Nature. What isn’t equal is how each farm manages risk.

Those who are averse to any debt often miss out on growth opportunities. Those who have a flippant

approach to debt often find themselves painted into a corner. It is a strategic and measured approach to

managing risk that sets apart the players in the game.

Leave a Reply

Want to join the discussion?Feel free to contribute!