Posts

Life…Another Cost to Manage

/0 Comments/in Financial Management /by Kim Gerencser“Despite the high cost of living, you’ll notice how it remains incredibly popular.”

We enjoy many benefits from living on the farm. So many are intangible: peace and tranquility, open

skies, fresh air, etc. Many others are tangible: be your own boss, grow your own food, continue a family

legacy, etc. Then there are those benefits that are measureable but rarely measured.

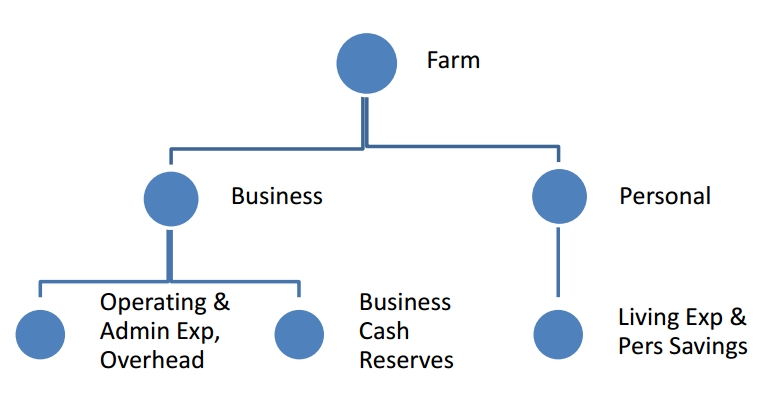

Any farm business doing even the slightest degree of cash flow analysis must give full disclosure on

personal expenses paid by the farm. There, I said it.

We all know that the farm pays the power, heat, taxes, and maintenance on the house; it buys the

vehicles, insures them, and put fuel in them. These are legitimate business expenses, whether it be a

portion of each or the entire cost. The point is, “Are you measuring it?”

This hits home for retiring farmers who are trying to calculate how much they need to live on in

retirement. Many of them are not used to paying for all of that, and more, from their personal

income…and all of the sudden they realize that CPP and their RSPs are barely adequate (if adequate at

all.) Interestingly, the intention of gifting the farm assets to the next generation isn’t as likely unless

mom & dad are going to frequent the food bank in their golden years.

Farmers that are paying themselves a salary, wage, or dividend from the farm and are truly paying their

personal (as in “non-business”) expenses from that personal income already have a clear grasp on this

concept. They understand the “pay yourself first” mantra and won’t be surprised at just how much it

costs to live when they transition out of farming.

I’m not saying that you must discontinue letting the farm pay for personal expenses; after all, it’s your

business. What I am saying is that you must measure it; you must know what that number actually is on

a monthly or annual basis. Picking a number that you “think” is close is not sufficient. Knowledge is

power; estimating is risk.

Direct Questions

Have you calculated how many personal expenses are paid by the farm? If not, why not? Saying that you

don’t want to know is not an acceptable answer.

If you are measuring it, what are you doing with the information?

From the Home Quarter

As a business owner, you have every right to operate your business how you see fit within the confines

of the law. But if you truly want to measure the level of success your business enjoys, this is one more

metric that must not be ignored. If you are afraid to know just how much you are spending personally,

that’s even MORE of a reason to do this, not less. In an era of tight margins, don’t we owe it to our

business, and ourselves, to manage every dollar appropriately?

Accounting, You Get What You Pay For

/0 Comments/in Financial Management, Operations /by Kim GerencserI am NOT an accountant. Let’s put that on the table right away.

“Do what you have to do so I don’t pay any tax, or at least as little as possible. And nothing fancy is

needed from you, just the basics; keep your fee small.”

Sound familiar? If you’re an accountant, I’m sure you’ve heard this far more than you’d like. If you’re a

business person (in the BUSINESS of FARMING) and you’ve said something like this to your accountant, I

hope this leads you to change.

The work your accountant does in preparing quality historical reporting will provide you, the CEO of your

business, with tools to evaluate actual results against expected results.

What do you mean you look at this info for 10 minutes, forward a copy to the bank, and then file it? I’m

a huge proponent of looking forward (future planning), but if you don’t look back once in a while to

gauge performance, you’re probably going to repeat some mistakes from the past.

A comparison of results year over year and setting trend lines of results can be telling. But this can’t be

done accurately without accruing your statements. Let’s put this in perspective: you sold some 2013

crop in 2014, and carried some 2014 crop into 2015, right? This isn’t unusual, nor is it a bad idea. We

should manage the timing of our grain sales to match our cash requirements. But for the purposes of

evaluating your farm’s financial success in a given year, the grain carryover skews the reporting. Here’s a

way to fix that: accrue your financials!

It’s not a lot of work. All you need to do is assemble your:

- grain inventory values

- total prepaid expenses (like fertilizer, chemical, and seed)

- accounts receivable

- deferred cheques

- accounts payable

Provide these to your accountant as they were on the last day of your fiscal year (and for the prior year

if you’ve never done this before.) You have to provide all of this to the bank anyway (or Agri-Stablilty,)

so there really is no extra work on your part.

Before anyone gets all panicky, I’m not suggesting you file your taxes on an accrual basis. Farmers can

still file on cash, so keep that up. Cash reporting for taxes. Accrual reporting for analysis.

Direct Questions

Do you view your accountant as a “necessary expense” or as a “strategic advisor” to your business?

Do you use your financial reporting to analyze actual results against projections?

Is the $2,000 you’re trying to save by “going cheap” with accounting worth the $1-2 million in financing

you WON’T get because your bank has “minimum reporting expectations” in order to approve credit?

Are you currently having your financial statements accrued? If not, please start now. A December 31

year-end can still be accrued. (So can historical statements if you have the info.)

If you don’t measure it, how can you manage it?

From the Home Quarter

Think about all the tools in your shop. Which one is your favorite? Could you see trying to get through a

major task without it? When you’re buying tools, do you shop at Wal-Mart, or do you buy Snap-On?

Your financial statements are just as valuable of a tool. And like any tool, its value is only evident when

you’re using it, not when it’s sitting on the shelf. Are you viewing your accountant like “Wal-Mart” or

like “Snap-On” based on the kind of “tool” you’re asking them to provide? And remember your

responsibility in creating quality reporting; the G-I-G-O rule applies. It’s up to you to provide your

accountant with thorough and clear information.