Let’s Make a Deal

Here is an incredible opportunity for you!

You can invest in a business that has grown its assets by 100% over the last 6 years. It has doubled its production and its staff compliment in that same time-frame. Revenues have increased by over 130% since 2005.

Interested?

No…why not? The description is accurate of many farms, maybe even one you know.

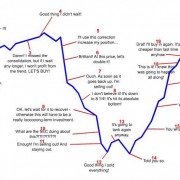

We’ve purposefully made no mention of liabilities or retained earnings, nary a word on profitability or cash flow. Sadly, it is because ignoring those is typical when expansion is allowed to be the critical success factor.

Investing in a business that has inconsistent profitability and little (if any) controls over cash flow is beyond risky. Is it any wonder that industry lenders demand detailed and accurate information before investing in your business?

To Plan for Prosperity

Do up a Debt to Net Worth calculation. If your figure is 1 to 1, that means your creditors have equal ownership as you in your business. If your Debt to Net Worth is greater than 1 to 1, your creditors have more skin in your game than you do.

If you wouldn’t invest in a business that cannot prove reliable profitability and consistent cash flow, why would anyone else?

Leave a Reply

Want to join the discussion?Feel free to contribute!