Happy Halloween

Let me first get this off my chest.

In this age of hyper-political-correctness, to hear of some schools that are “cancelling” Halloween because of the risk that some costumes might “offend” or “scare” someone is taking us down a path that we may not be able to come back from. I’m not a proponent of Halloween, but I’ll gladly encourage anyone who wants to take part in it to do so, and anyone who doesn’t can also do so. What we need to remember is why we do it, even if we don’t love it…IT’S FOR THE KIDS!

It’s THEIR imagination and THEIR excitement that must not be squelched just to satisfy our guilt over ________ (fill in the blank).

Thank you; now onto the real business at hand.

Getting dressed up in a costume creates an outlet for us to be something we’re not, or maybe something we wish we could be. (As a kid, I wanted to be a pro-football player and might have dressed up as such for Halloween.)

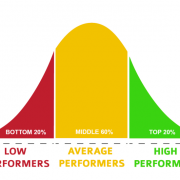

Over the last several years in western Canadian agriculture, “average management” has been dressed up in a costume of “excellence.” With high yields and high commodity prices, even average managers were more profitable than they had been in the long term…maybe ever.

Dr. David Kohl uses the term “black swan” to describe the recent commodity super-cycle because, like a black swan, it is “not the norm.”

A black swan is an event or occurrence that deviates beyond what is normally expected of a situation and is extremely difficult to predict;

Source: www.investopedia.com

While we might be inclined to associate black swan occurrences with negative deviations from normal, in the case of the last 10 years in agriculture, we’ve experienced a positive deviation from normal. The danger came when many participants in the industry believed that what was happening wasn’t actually a black swan but “the new normal.” Many long term decisions were made based on short term results. True to the black swan definition, the onset of the commodity super-cycle was predicted by very few, and even fewer still predicted it would last as long as it did. Maybe it was the fact that it did last longer than a year or two is why people started to believe it would never end…?

The unpredictability of this black swan continues to cause angst among players in the industry. Some are soldiering forward as they have for the last several years with full expectation that the black swan will return. Others are are in full damage control mode, or even panic mode. Others yet are patiently waiting for the opportunity that always follows the economic cycles.

Market cycles will hurt some, but offer opportunity to others.

The difference between who suffers and who prospers is…Who’s Ready.– Kim Gerencser

I started making that statement way back in late 2012. The message then was to take advantage of the current up-cycle to solidify your business in preparation for the upcoming down-cycle (because bulls are always followed by bears, which are followed by bulls…it is how cycles work.) Being greedy during an up-cycle brings up another old adage, “Pigs get slaughtered.”

To Plan for Prosperity

When preparing your 2018 projections, compare your projected expenses to your worst revenue in the last 10 years. Is there a negative gap? How big is it? What needs to be done to cover it? Alternatively, is there a positive gap? How big is it? What needs to be done to protect it, or even to leverage it so as to make it wider?

The exercise proposed above is comparable to removing a Halloween costume. While things look one way outwardly, what is actually happening underneath, at the surface, can sometimes be much different and will tell the true story.

Happy Halloween!

PS. Don’t wear your Halloween costume to your banker meeting.

Trackbacks & Pingbacks

[…] cycle (2007-2013) allowed below-average management skills to generate above-average results? (Ref. Vol.3 /No.44 Happy Halloween) Even those producers who were not able to produce a profit from operations could still show that […]

Leave a Reply

Want to join the discussion?Feel free to contribute!