Seeking Excellence

This is a verbatim copy of Seth Godin’s daily blog from April 22, 2015:

Demand higher standards.

On a long flight a little while ago, I saw two couples watch movies while they let their six kids

run around like maniacs from take off to touchdown. A seven-year old actually punched me. (I didn’t return the punch).A few days later, I saw the now-typical sight of kids in a decent restaurant eating french fries

and chicken fingers while watching a movie on a tablet.And it’s entirely possible you have a boss that lets you do mediocre work, precisely whenever you feel like it.

I wish those kids had said, “Mom, Dad, raise your standards for me. I deserve it.”

And the sooner you find a boss who pushes you right to the edge of your ability to be excellent, the better.Even if the boss is you.

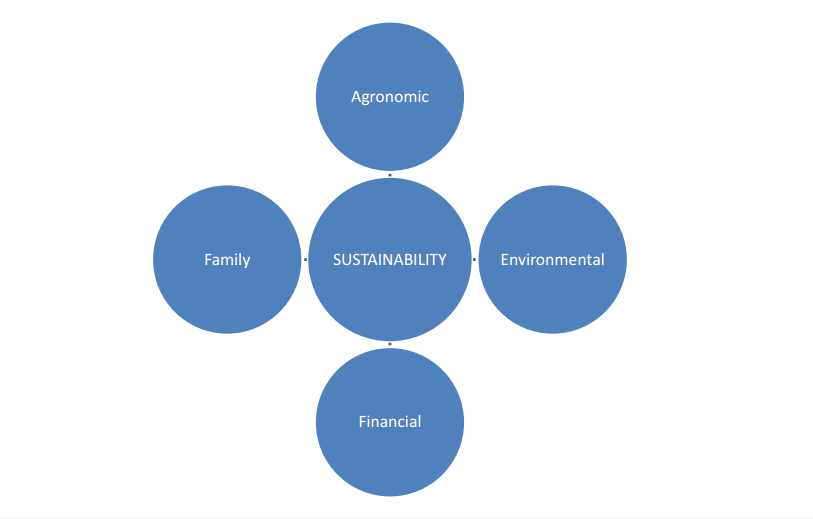

I couldn’t help being captivated by this simple and direct message (Seth is famous for them.) In

agriculture on the Canadian Prairies, we’ve generally been just fine by being somewhere south of

excellent. We haven’t needed to be better in business because we use excellent production practices;

Canadian farmers are arguably the best producers in the world. We haven’t needed to be better in

business because money is cheap and easy to acquire; interest rates have never been lower and lending

terms continue to be very favorable. We’ve gotten away with being mediocre, or somewhere south of

excellent, in our business skills because “the average was just fine.”

We would be happy if every year we got average rainfall, average heat units, average weed pressure,

average yields, average prices, average input costs, etc. It would be easy to farm if everything was just

average.

But it’s not.

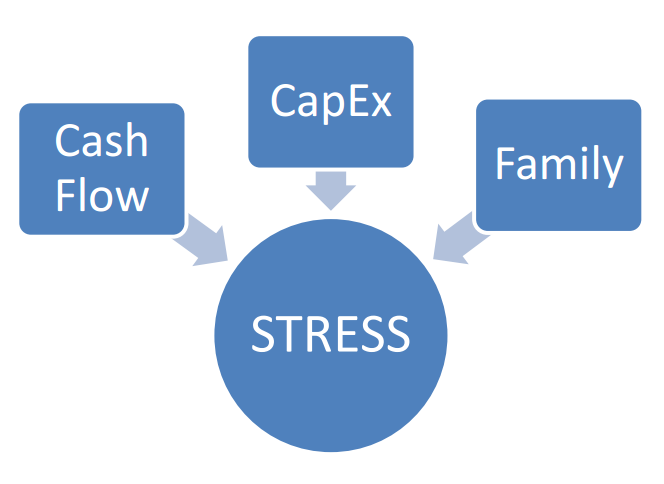

And if you’re average in your management of your business and all its risks, it is pretty tough to expect

excellent results. We’ve enjoyed a 7 year bull run on yields and prices which has permitted “average” to

disguise itself as “excellence.” Are we still comfy thinking that recent history is our new normal? I

listened to Dr David Kohl in person 4 years ago and he said then that these highs in yield and price are a

black swan, and not the new normal. “Normal” is “the average” and since the average has managed to

disguise itself as excellence over the last several years, what will happen when this black swan migrates

out of here?

When the black swan flies away and “normal” returns, “average” will not be sufficient. We will still be

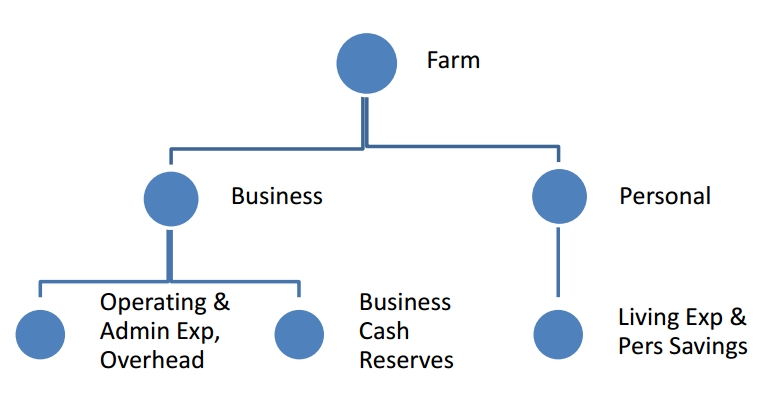

excellent in production; we may still have cheap and easy access to money. As you read in Growing Farm

Profits Weekly on April 14, 2015, farming is a lot more than just production. And easy money is

dangerous when in the wrong hands. If there are no guarantees that Mother Nature will offer a growing

season to facilitate excellent production, it will take the excellent production practices for which we are

famous to just be average. That is “average” without its disguise.

As Seth wrote, the sooner you find a boss that pushes you to edge of your ability to be excellent, the

better. If you are your own boss, like you, like me, like all entrepreneurs, we must find a way to be

excellent.

Direct Questions

In what areas of your business is your proficiency less than excellent?

Have you greatly shifted the parameters of what you call “average?”

Considering all the risk you face each year as a farmer, can you afford to be anything less than excellent?

From the Home Quarter

The message here is not to suggest that anyone has intentionally done a poor job of running their farm.

What is being suggested is that the recent ag environment has permitted great success without

requiring excellence across all aspects of the business. I am supremely confident that will change, and

anything less than excellence through your entire farm will offer disappointing results.

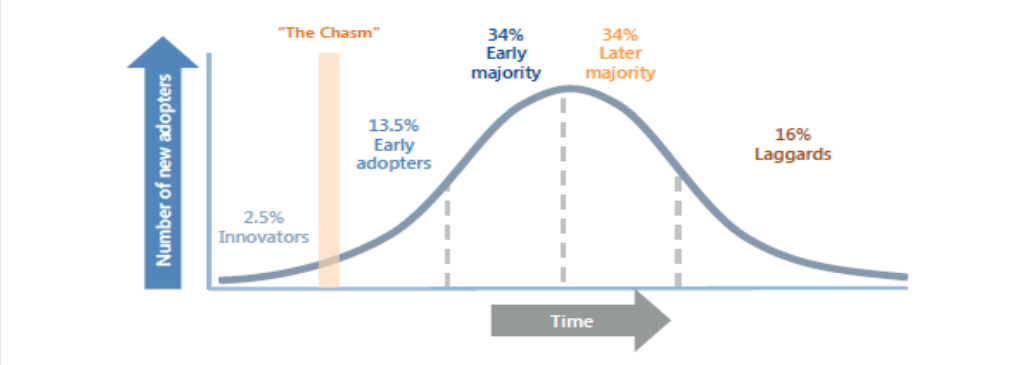

*The Innovation Adoption Curve www.b2binternational.com

Excellence is a choice. Have your competitors already chosen excellence? When it comes to employing

excellence in business proficiency, you want to be on the left side of the curve above. I have a mentor

who helps me to be and stay excellent. My mentor has a mentor who does the same for him. It’s not

easy, but it’s worth it. As I’ve said, and will continue to say, “Do what you do best, and get help for the

rest.”

If you want more than average, call me. The Department of Excellence is open for business!