Goal Congruence

Have you been beat up enough yet about “defining your goals”? Every article I read relating to business management and every presentation I attend relating to business management always brings up the need for you as the businessperson to “define your goals.” For the record, “business management” in the context of this piece also include business transition (succession) planning.

The beatings will continue. They’ll continue as until everyone doesn’t just listen to the advice, but acts on it.

More often than not, when I ask a client (or even a prospective client) what are their goals, I get a blank stare, as if the concept is a foreign language. Far too many business owners have given little consideration to what they are trying to achieve in the business.

If it’s just a place to work and/or a lifestyle to enjoy, then declare it as your goal.

If it’s a family legacy that has been left to you that you intend to leave to your children, then declare it as your goal.

If it’s to achieve the largest scale in your market area, then declare it as your goal.

If it’s to create financial wealth and prosperity for you and your family, then declare it as your goal.

Don’t just tell the advisor you’ve hired, and paid well, that your goal is “to make more money.” That’s everyone’s goal, whether employed for someone else or self-employed like you. Let’s get serious.

There are four sample goals described above. These four have been chosen because they are the most common goals I have identified in working with entrepreneurs for the last 15 years. What I mean by “identified” is that while some of these goals have been declared, it’s more common that the goal is insinuated by (or surmised from) the behavior of the owners. The problem is when business owners try to combine more than one of those four sample goals listed above; this happens almost all the time.

The first goal listed, lifestyle, is not congruent with any of the other three.

We’ve learned that largest scale does not automatically equate to increased financial wealth and prosperity; again, not necessarily congruent.

The only congruity among the four samples is between family legacy and financial prosperity.

– yet behaviors often do not follow those goals.

It is advisable to have multiple goals in business and in life. In business, none of the goals we may have can be achieved without prudence in financial management. Remember, profit feeds your business, it feeds your family, and it feeds your ability to spend time with your family & on other things you enjoy. If you feel uncomfortable declaring one of your business goals to be financial wealth because you don’t want to be thought of as a greedy person, then don’t declare it, but for the sake of your business’ and your family’s future, behave like it. If you’re not profitable, if you’re suffering under the pressure of non-existent working capital, or worse, then none of your goals are achievable. Period. Hard stop. I’m sorry to have to deliver that cold truth in such a harsh manner.

To Plan for Prosperity

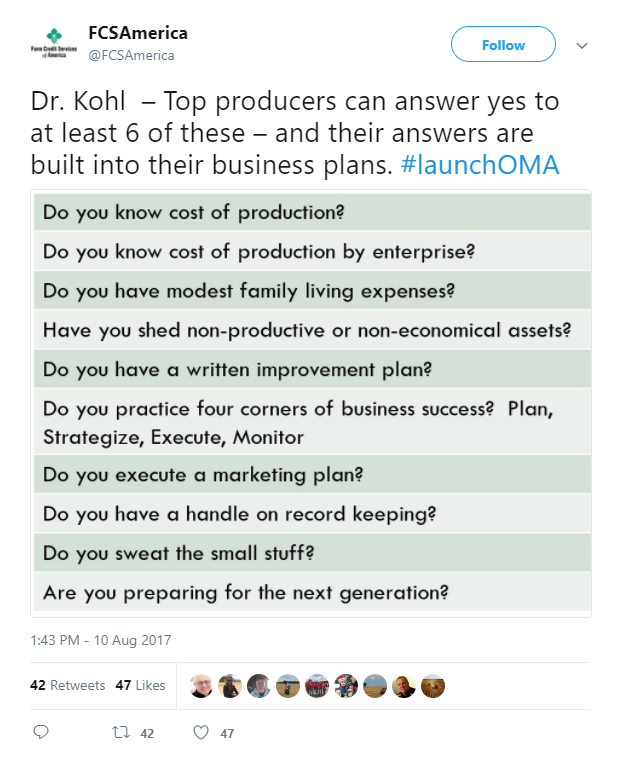

The challenge I lay out for all entrepreneurs is this: be clear on why you do what you do, establish working parameters and behaviors that support it, and evaluate your progress & results regularly to ensure you’re still on track. How sad would it be to never check the map for the entire journey only to end up somewhere you never meant to be?

Not only must your goals be congruent, but your behaviors must be as well. You and your business face enough turmoil, challenges, and risks. Don’t create more challenges by making decisions that aren’t congruent with your goals.