Prevention or Contingency?

I read Alan Weiss regularly and one of his daily blog entries from early July gave me inspiration for this

week’s article.

Alan consults to Fortune 500 Companies and solo practitioners alike, and in the entry I refer to he asks

readers, “What are you doing with your clients, helping them to fight fires or to prevent them?”

Currently, I’m doing as much fire-fighting as I am fire prevention. I enjoy the latter far more, and I know

clients do to.

The challenge is that it is hard work to build and implement a prevention plan. It’s more fun to “give’r

while the going’s good” and figure out the rest later. For many farms, later has arrived and now it’s time

to fight fire.

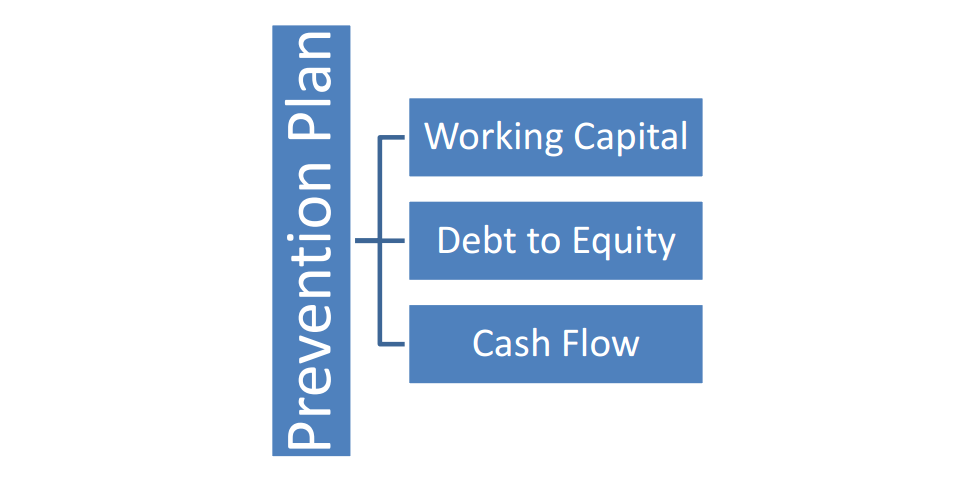

The prevention plan will consider 3 metrics that must be maintained:

1. Working Capital

2. Debt to Equity

3. Cash Flow

Working Capital is simply the difference between your Current Assets and your Current Liabilities. To

complicate things, there is a process on how to include accurate figures for each; it’s not hard, but it

takes work. If your working capital is negative with little opportunity to return to positive, seek help

immediately.

Debt to Equity, usually represented as Debt:Equity or D:E, is a ratio of your total liabilities to your

equity. For realistic measurements, calculate your net worth for the equity figure. Net worth is fair

market value (FMV) of all “owned” assets less all liabilities. The difference is your net worth. If your

debts are $2million and your net worth is $1million, your D:E = 2:1. In some industries, a D:E of 2:1 is

acceptable; in agriculture, it is considered too high. Target your D:E at 1:1 or less.

Cash Flow is going to be the new-old buzz word. As it was the dominant focus of the 1990’s and early

2000’s, cash flow will once again be front and center. Total up you cash flow requirements for the year

and don’t leave anything out (like living expenses.) When compared to what expected gross production

revenues are going to be this year, are you happy with the result?

Direct Questions

Can you recognize and describe the importance of adequate working capital?

Debt to Equity is a measurement of “what you owe versus what you own.” Are you happy with how your

metric balances out?

Cash makes loan payments, equity does not. Are your financing obligations using up the cash you need

to pay bills, cover living expenses, or build adequate working capital?

From the Home Quarter

Your prevention plan needs to have these three metrics measured, tested, and measured again.

Strategies for how to manage your finite resources so as to build and maintain a prevention plan are

easier than fighting fires or trying to put together an emergency contingency plan when you first see

smoke. You might have excellent fire-fighting skills, and your contingency plan could be water tight, but

the fire still occurred. Isn’t it better to prevent what caused the fire then to fight it?

If you’d like help building your farm’s prevention plan, then call me or send an email.