Change, Risk, and Fear

Change brings risk. Risk brings fear.

“Risk and the appearance of risk aren’t the same thing.

In fact, for most of us, they rarely overlap.

Realizing that there’s a difference is the first step in making better decisions.”

Change is the only constant in life. Charles Darwin is often credited with saying, “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.” There is no question that when it comes to production practices, farmers’ ability to change is very apparent.

Now if that would only apply everything…

There is a change on the horizon that almost every farmer will face: how to adapt to life when he or she is no longer farming. That tune has been sung, and will continue to be sung until the message gets through. Yet, by the relative inaction of most farmers to address succession, or transition as it is often called, it is easy for those of us beating the drum to ask, “Why aren’t they getting the message?” I’m less sure that the message isn’t getting through; I’m more convinced that it is the act of facing change that harks fear into the farmer.

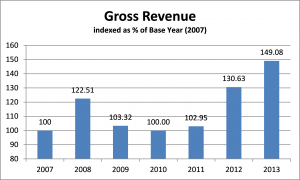

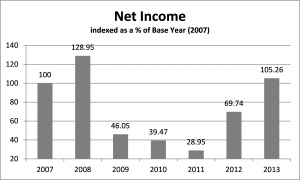

Risk, on the other hand, is something every farmer has an appetite for. Without it, one cannot farm. The act of dryland grain farming in its simplest form carries more risk than most non-farmers could even comprehend. Contrast that to the risk that many farmers take in relation to cash flow and debt, and I have to question their comprehension of risk.

One will not fear what one perceives as zero risk. Lacking appreciation for the financial risk from decisions that will strain cash flow and debt levels is why there is little fear of that risk. Lacking action on addressing farm transition is based on a perceived risk.

“Risk and the appearance of risk aren’t the same thing.” The financial risk that many farms put themselves in stems from the LACK of the appearance (inability to fully grasp) of risk. The avoidance of the farm transition discussion is a result of the appearance (created in one’s own mind) of risk. In both cases, the real risk is not considered, but the appearance of risk, or lack thereof, is given full credit.

Direct Questions

What is the REAL risk of farm transition activities? That the next generation won’t do it as well, or the same as you…? (HINT: your dad felt the same way when you took over and you did just fine!)

If you believe a risk does not exist if you do not acknowledge it, explain how that same theory would work with your spouse or children?

Fear is a very real motivator, or demotivator. How do you go about understanding the risk to mitigate the fear?

From the Home Quarter

With change, there is always risk. Risk has an effect on everything we do, whether the risk is real or perceived. The fear of negative (or undesirable) outcomes can be crippling. It is easy to see how change can bring immediate crippling fear now that the connection has been made.

Change the way you look at risk, and you’ll have less to fear.