It’s harvest time. The weather has been uncooperative. The crop is generally not ready to go. Quality is diminishing. The August and September contracts Fred* had in place will not be delivered on time, even though the elevator has room, because his grain is still in the field and not in the bins. (* Fred isn’t anyone in particular. This story is fictional, but we need a lead character and decided to call him Fred.)

Finally, it looks like the weather will break, forecasting two weeks of high pressure, clear skies, and warm temperatures. Fred even has enough help between the hired staff, and family who have offered to come home for a week or so. He must get this crop off quickly, as fast as possible. Fred needs another combine.

Fred cannot afford to think about this for too long; everyone is in the same situation, and they could be looking at adding a combine to their farm as well. He heads into town, speaks with his salesperson, and acquires a quote. It’s higher than he wanted, or was expecting, but Fred is in a bind. He just heard that there are 2 other quotes on the same unit. He writes the cheque for a deposit.

Now comes the hard part – seeing the banker.

Fred recalls the feedback he was given before seeding time: things have been a little tight, and pulling back on any capital expenditures for a couple years would be best. What if this gets declined? How will he get the crop off in time? Is his deposit refundable? Fred scolds himself for not asking when he wrote the cheque.

Fred arrives at the banker’s office unannounced. Luckily she’s in the office today. Thankfully he doesn’t have to wait long. He explain the situation: things are getting worse by the day with poor weather degrading crop quality, and thereby crop price; he has lots of help to run extra equipment to get harvest done in record time…if he had another combine. When she asks if a decent combine can even be found at this juncture, Fred proudly produces the quote he just received no more than a half hour ago. She says she’ll take a look at things, and call right after lunch.

Fred heads home. The temperature is climbing and the wind is blowing; he thinks he could maybe get going this afternoon. Everything is serviced and ready to go; after all, he’s only done 150 ac so far. Fred heads in for lunch early, hoping that will speed up the call he is anxiously awaiting from the banker. He scans his phone for afternoon market updates, text messages from any neighbors who might be rolling, and that critical phone call from the banker that just isn’t coming fast enough.

He can’t sit around; Fred fires up the combine to go out and get a sample. The wheat sample looks bleached. He figures he’ll be lucky to get a #2. Sticking his hand in the pail Fred thinks “It feels close.” He rushes back to the yard to test it: 14.8! That can go in aeration! Let’s go!

Fred reaches for his phone to let everyone know to get ready to go, but realizes he left it in the combine in the field from which he just took a sample. Fred jumps in the semi, and even though it hasn’t warmed up enough yet, he hustles out to the field. Word will get to everyone via the house phone, and they’ll get out to the field right away.

Once back in the combine cab, Fred finds a message on his phone: it’s the banker! She wants him to call her right back. He does, and the call goes straight to voice mail. Fred swears.

She calls back in the time it took to fill one hopper. As Fred unloads into the truck, she tells him that she cannot approve a loan for the combine. She says that Fred’s cash flow is too low and his debt levels are too high to take on another liability for a “nice to have” asset. She talks about other options for this harvest, and offers clear feedback on what needs to happen in the future to not have these kinds of interactions with her again, but Fred has already stopped listening because he’s moved on to thinking about who else he can call for financing, wondering if the dealers program can turn an approval in less than an afternoon…

Fred immediately calls his salesperson at the dealer, and a couple other leasing companies, to ask them to begin an urgent credit application. They’ve got all his information now; he’s been in touch with them a couple times this year already when the banker has denied his other requests. Fred begins to wonder why he even bothered with the bank this time.

An hour later, Fred gets a call from the dealer; their financing division has approved his combine loan application. The interest rate is higher than his other loans, and the payment terms are more rigid, but he is not worried about that now – Fred can get that extra combine!

Jubilation turns to anxiety: the dealer cannot deliver until next week, and it hasn’t been through their shop. Fred will need to invest a half-day to have someone drive it home (who can be freed up to do that now that the harvest is rolling again?) Fred realizes this combine will probably need some repairs and some parts (more trips to town on the weekend.) On top of all that, he realizes that he’ll have to shut down himself to go in to town, sign the loan, sign the equipment sale agreement, and hopefully get to the insurance office before they close for the weekend. At this point, Fred might as well drive it home himself!

Yup, having a 3rd combine will make short work of Fred’s 5,300 acres! He acknowledges that he’ll have a serious amount of harvesting capacity for his farm size, and despite what he was told by the banker in spring and again today, Fred still got approved the loan. And if Fred got the loan, his business can’t be in as bad of shape as the banker says, right?

Direct Questions

Why does Fred exclusively use his creditor’s approval or decline of his credit applications as the barometer of his business’ financial stability and position?

How does Fred account for the differences in lending criteria and motivations between creditors when using their feedback as his business barometer?

What do you use as your barometer of business health?

From the Home Quarter

In our story, Fred clearly does not take the time, nor does he have the interest in understanding the financial ramifications on his business from the emotional decisions he makes. He continues to forge ahead by using any and every source of credit he can grasp. What happens when his requests are denied? Is it only then that his farm is in a position of financial weakness?

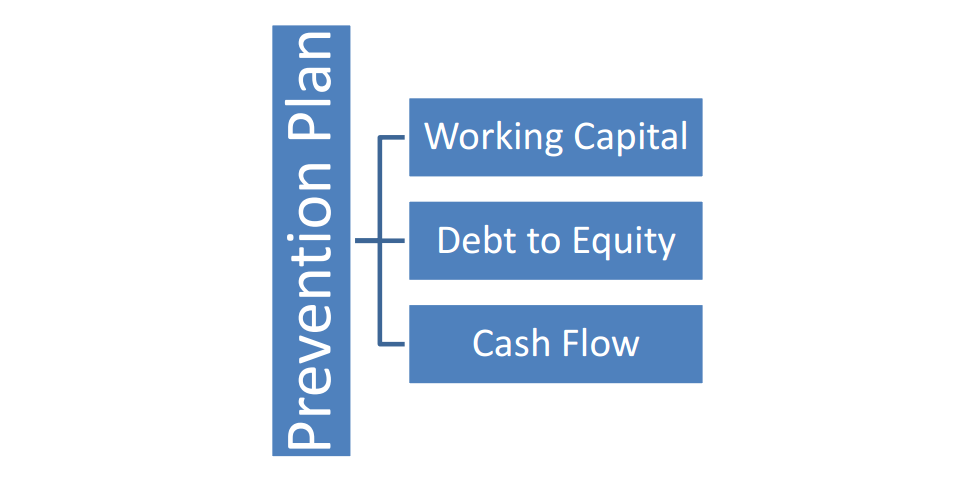

When focusing on priorities, I advise my clients that there are often times more important issues than upgrading equipment and constructing more buildings because credit is (relatively) easy to get, and has been for some time. As such, using credit approvals as the only, or primary, business barometer is narrow in scope, biased in feedback, and lofty in risk.