Perspective

What do you want to accomplish between now and Oct 1, 2018?

If I had asked many of you that question one year ago, you might have provided a response that would make you cringe using the lens of today. Last year, may farms were suffering from excess moisture, and long drawn out harvest. On this date one year ago, there were millions of acres yet to be harvested in western Canada. If one year ago you were hoping for a hot dry 2017, well…you got it.

How has your perspective changed over the course of a year? What is affecting the change in your perspective? If you’re more concerned about short term fluctuations rather than big picture issues, such as a recent market correction versus the tax changes currently proposed by our federal government, then you’re probably looking down the hood of the truck instead of down the road.

If you’re more concerned about short term fluctuations rather than big picture issues, then you’re probably looking down the hood of the truck instead of down the road.

My best client relationship has evolved from our original work of clarifying Unit Cost of Production by drilling down operating and overhead costs, so that we are now pursuing 5 year expansion strategies and establishing tactics for handing off management activities as part of a transition plan that is still 5-10 years away.

In the next breath, when asked “What is the greatest challenge on farms today,” I regretfully cutoff whoever is asking the question by blurting out “cash flow.”

I see numerous farms who do not suffer cash flow challenges. They experience the same weather, the same markets, the same interest rates. Yet somehow these farms do not suffer under the same cash flow pressure. Why is that?

Perspective.

Successful businesses have a long term perspective. Those businesses recognize the variability in the aspects affecting their business that they cannot control (like weather, markets, interest rates), and as such, they prepare themselves and their businesses for what’s coming “down the road.”

Looking down the hood instead of down the road doesn’t give you time to prepare and react to what’s coming up ahead.

Here is an easy recipe to help prepare for what’s coming up “down the road”:

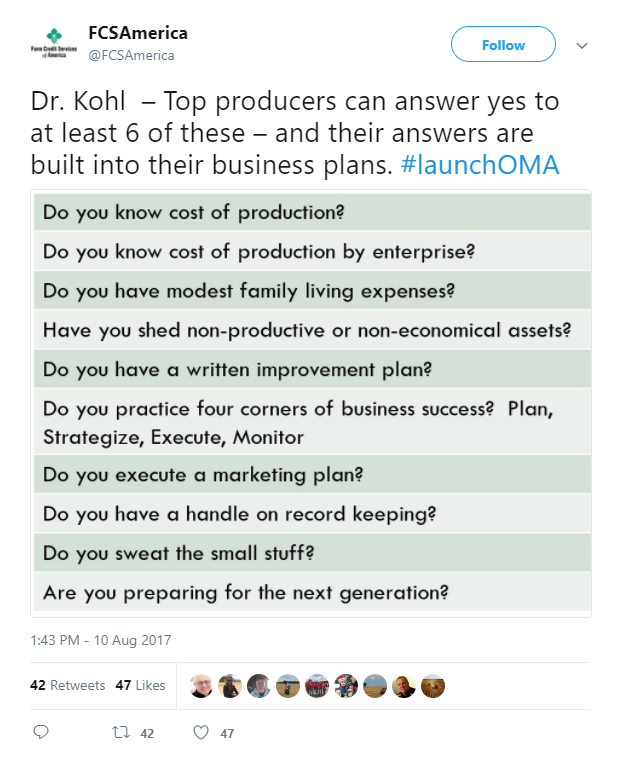

- Understand cost of production, right down to the paperclips.

- Get lean in how you manage your operating and overhead costs.

- Maintain modest personal drawings.

- Eliminate unnecessary assets and the debt they bring with them.

- Build working capital to a minimum of 50% of annual cash costs.

By implementing these 5 steps into your action plan before spring, you will instantly be miles ahead of your competitors one year from now.

To Plan for Prosperity

There is no crystal ball in my possession, so I cannot predict what is coming down the road. What I can tell you is that I have seen the effects of business cycles on the unprepared, I have seen the effects of poor perspective on the oblivious. Conversely, I hold great admiration for the business people who had the foresight to control all that they were able to control, including how they were affected by that which they couldn’t control.

What’s your perspective?