I Can Do It Alone…

As entrepreneurs, we generally put our shoulder to the plough and find a way to power through the

work that lay ahead of us. Staunchly independent, we rarely ask for help. I believed that for quite some

time myself…I mean, it’s a pride thing right?

Then my mentor gave me 5 simple words, so impactful and so true, yet these are words we’d never

recognize until someone throws them in our face; “You can’t consult to yourself.”

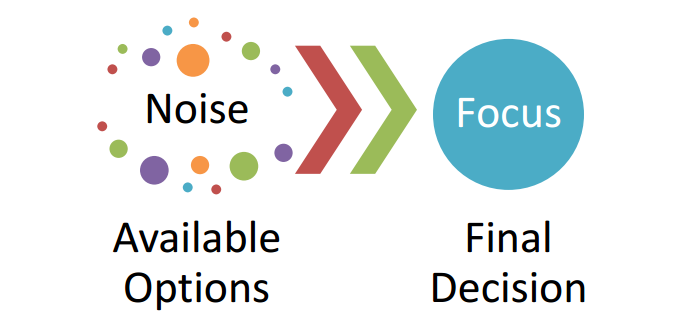

I can’t build my business alone. I can’t be an expert at everything. There is no way I have enough days in

this lifetime to gather all the knowledge, experience, feedback, networking, and intellectual property to

“do it all myself.” I need help in areas where “I don’t know what I don’t know” and so I seek it out from

others who have proficiencies that I do not. I’ve hired a consultant, and I take part in some excellent

networking associations.

I belong to two ag focused advocacy groups: Saskatchewan Young Ag Entrepreneurs (SYA)

www.saskyoungag.ca and the Canadian Association of Farm Advisors (CAFA). www.cafanet.com These

are not lobby groups, or policy groups; they are not groups focused on any one commodity or sector.

They are channels for farmers and farm advisors to share successes and struggles, discuss challenges

overcome and opportunities lost. These are the places to learn what your peers are doing right, and to

learn from their mistakes. Neither increases my workload with committee obligations and the like. Both

groups are completely focused on improving the industry we are all so passionate about.

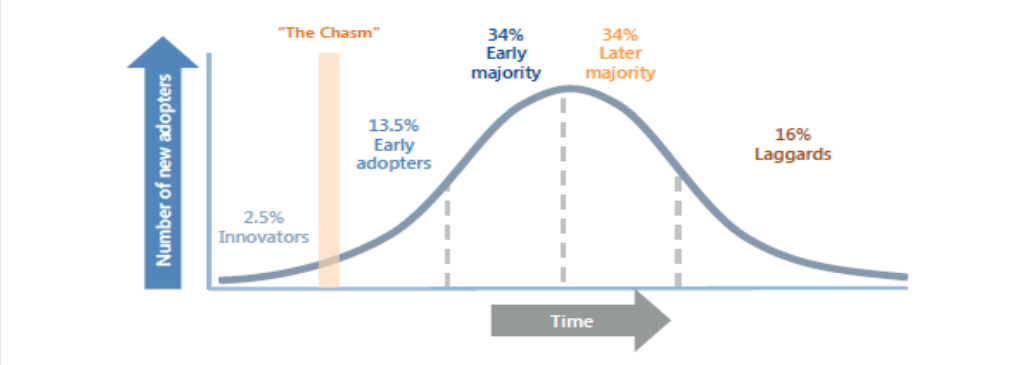

SYA is a young dynamic cross section of what the future of farming looks like in Saskatchewan. I describe

this group as “the movers and shakers; the future of our industry.” Typically under age 40, these

entrepreneurs vary from small acre grain and mixed farms, to large scale grain operations; from organic

farms to farm advisors/suppliers/retailers. Each member brings something unique to the table.

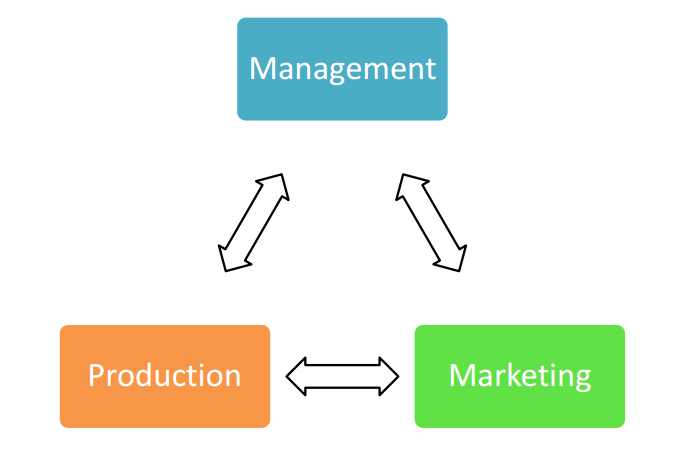

CAFA is a national organization that is meant to bring together the advisors that help farmers with the

complexities of operating such a diverse entity. This group includes everyone from bankers to lawyers,

agronomists to accountants, grain marketers to tax and financial advisors, management consultants to

farmers (yes, we have a few farmers involved and they all speak very highly of being a part of CAFA.)

This group helps me, as a management consultant, understand more about other opportunities to help

my clients in areas that I am not an expert. We all have the same goal: find new ways to make our

clients better off. I regularly engage my CAFA colleagues when I have a client with an issue that needs

more expertise than I have (like HR strategies, estate planning, etc.)

These 2 groups provide me with a terrific combination: one group helps me stay on top of what is

keeping farmers up at night by listening directly to a diverse collection of farmers face to face and not

hearsay or coffeeshop chatter; the other group helps me strengthen my skills and my network of

qualified peers who can help me help my clients. I value each of these groups equally, and work hard to

never miss a gathering.

CAFA has regional chapters that meet monthly. Always with a topical presentation from an industry

expert, it’s 1-2 hours once per month (usually over breakfast or lunch.) The annual provincial conference

(yes, each province has one) is scheduled in the winter.

SYA meets a handful of times each year, mostly because the membership is busy farming!

But their PreSeeding Social, their Provincial Farmer’s Golf Tournament, Field of Dreams Tour, and Winter Convention

are always informative but most importantly, FUN!

So if you’re still reading, you may be wondering why I have dedicated an entire article to these two

associations. It’s simple: both are agnostic in their focus (as long as it’s AG,) both are tremendously

beneficial to me and my business, and both have found themselves generally flying under the

radar…meaning neither gets much press in print or on TV/radio. Neither operates with a big budget to

afford more advertising, yet both need to have more attention paid to them because of what they bring

to the table.

Direct Questions

Who do you turn to for feedback, when you need a sounding board, or if you want to learn about

firsthand experience on a new topic, idea, or strategy?

Do you ever find yourself wishing you had a mentor, or someone who has been down the same road

you’re travelling?

Have you found yourself facing a situation or dilemma where you didn’t know what to do or who you

could call for help?

From The Home Quarter

It is funny how easily we can become an island, feeling alone in our own world with little opportunity to

change the situation. Social media is great, but it cannot ever replace human interaction. It doesn’t have

to be that way. There is always someone who has faced the same battle you are facing today. There is

always someone who has expertise in an area in which you feel overwhelmed. There is always someone

who knows someone who knows what you need to know (referrals go both ways!) Membership in

either of these associations is an investment in yourself and your business.

If you’d like help planning your farm for business and personal success, then call me or send an email.