Expansion Plans

Harry* is one of those subtle role models that every farm community has. While no one treats him like royalty, nor does he act like it, everyone knows Harry is highly respected, not just here at home, but in the agriculture community across the entire province. He has quietly, and diplomatically, build his own little empire.

Most people wonder how Harry has done it. True, they are a little envious, but they cannot understand how Harry could be so well off compared to most others in the area when he gets the same weather, he farms similar soil, and grows similar crops as everyone else. Harry’s yard is always neat and tidy, his buildings are clean and kept up, and his “not new, but not old” line of equipment shines like a new dime despite some of it being over ten years old. There are three new 60,000 bushel bins going up this spring, and a concrete pad has been poured which, if you believe what you hear on coffee-row, is for a new grain cleaner.

Harry has expanded his crop acres a little at a time, never making a big splash in the market. Neighbors usually come to him because they know he is a character guy: he always pays his rent on time, he respects their land, and he keeps them informed. Through rent and purchase, Harry has taken the 1,200 acres he inherited from his parents in 1984 and has grown it to 8,600 acres today. He owns about 6,000ac and rents the remaining 2,600.

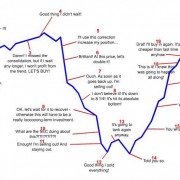

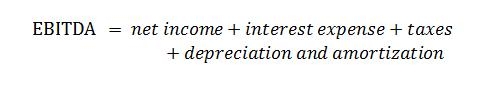

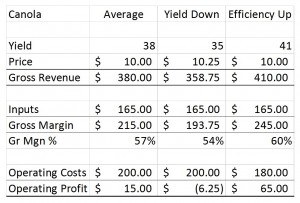

Harry heeded some sage advice when he started out. He was told that production is only part of the equation; the haughtily delivered quip stuck with him through the years, “Farmers don’t get paid for growing it, they get paid for selling it!” While production is incredibly important in the commodity business, Harry learned early that in the commodity business you have to produce as much as possible as cheaply as possible. Efficiency of finances and expenses, not just operations, would be key.

Harry has worked diligently to keep his costs down, especially equipment. Despite easy credit and low interest rates readily available, Harry has stuck to his guns when solicited with discounts and deals on newer equipment. He has drilled down on every operation on his farm, and can tell you quite accurately what his entire cost is per acre, including labor and depreciation, for seeding, spraying, harvesting, and trucking. He knows off the top of his head when he is better off hiring custom work or doing it himself by comparing the custom rate he is quoted against what he knows are his “all in” costs.

Harry recognizes that he cannot be an expert at everything. He knows he is an operations expert because he has managed his costs to their lowest reasonable point and because he manages his crew and makes all logistical decisions to get 8,600 acres seeded and harvested with greater efficiency every year. Harry knows he is not a human resources expert, so he’s taken coaching in order to improve his employee relations; he knows he is not an expert in international grain markets, so he’s hired an advisor and subscribed to market intelligence services, he knows he’s not a financial expert so he heeds his banker’s advice and has even hired a financial and capital expert to increase his confidence in the decisions he wants to make.

Harry has been thinking about expanding the farm for a couple years now. His two children, now in their early twenties, have shown a real penchant for the farm. After taking his advice to work somewhere else (either in or outside of agriculture) and to get a post-secondary education, Harry’s children have solidified their dedication to the family farm, bringing with them their outside work experience and their formal education: one with a Bachelor’s of Science in Agriculture, the other with a Bachelor’s of Commerce. The kids get along fine, and work very well together. Their differences in interests and education will bring a real synergy to the passion they share for the farm. Harry is incredibly proud.

Two of Harry’s neighbors have been thinking about retiring for a number of years now. Being the proactive strategist that he is, Harry has been discussing the possibility of expanding the farm with his advisors. Today, Harry is supremely confident that he knows exactly what upgrades need to be made to equipment and labor, and how it would affect his balance sheet, income statement, and cash flow, should he be successful in taking on more acres.

When Harry heard that Fred’s effort to rent the land of both neighbors came up short, he was honored when those neighbors came to Harry and asked him to rent their land. Having been planning for this opportunity for almost two years, Harry has been aligning his resources and as such he has abundant working capital to take on about 2,000 acres from each of his two new land partners. After having coffee with each neighbor for a couple hours, Harry has acquired the knowledge he needs and now knows what he will seed on which field. He calls his supplier to inform them of the additions to his original corp plan and procures the required inputs. Despite it being early April, Harry gets everything in place smoothly. He knows full well what a stressful mess this new land would be if he just tried to pull the trigger without planning for how to get it done.

To Plan for Prosperity

If the story above sounds too idyllic, please know that Harry’s last name is not “Perfect” (Get it? He’s not “Mr. Perfect”!) Harry hasn’t done everything right, and he doesn’t do everything right on a daily basis. What he has done different, what he does so well is that “he knows what he knows, and he knows what he doesn’t know,” and as such, he has equipped himself with the right help and advice to fill the gap. What might be the most important thing that Harry does well is that he makes a plan, and uses great discipline to not allow temptation to lead his plans astray. He avoids the temptation to increase his costs from high priced equipment or fancy yield-exploding elixirs. He maintains his strategy of keeping costs down, and protecting cash flow & working capital as the life-blood of his business that it is.

If you asked Harry, he’d admit that there are many decision he would have made differently from knowing what he knows now. But, being strategic and disciplined has allowed Harry to grow his business, not only in size and scale, but in efficiency, profitability, confidence, comfort, and lifestyle.

*Harry is a fictional character. The story portrayed above is fictional. Any similarity to a real person or situation is purely coincidental.