Complex Decision Making

On October 21, 2017, Seth Godin wrote the following:

Decision making, after the fact

Critics are eager to pick apart complex decisions made by others.

Prime Ministers, CEOs, even football coaches are apparently serially incompetent. If they had only listened to folks who knew precisely what they should have done, they would have been far better off.

Of course, these critics have a great deal of trouble making less-complex decisions in their own lives. They carry the wrong credit cards, buy the wrong stocks, invest in the wrong piece of real estate.

Some of them even have trouble deciding what to eat for dinner.

Complex decision making is a skill—it can be learned, and some people are significantly better at it than others. It involves instinct, without a doubt, but also the ability to gather information that seems irrelevant, to ignore information that seems urgent, to patiently consider not just the short term but the long term implications.

The loudest critics have poor track records in every one of these areas.

Mostly, making good decisions involves beginning with a commitment to make a decision. That’s the hard part. Choosing the best possible path is only possible after you’ve established that you’ve got the guts and the commitment to make a decision.

With the benefit of hindsight, none of us is ever wrong. We can, without fear of reprisal, predict what just happened 5 minutes ago.

In business, we can not afford to avoid the complex decisions. Leaving it to chance or following the crowd is about as solid of a strategy as allowing “hope” to be your business plan…

In the next breath, we must cut ourselves some slack; large and complex decisions are daunting. It can seem easier to do nothing than to tackle a complex decision and risk making the wrong choice. But, as Godin wrote, “making good decisions involves beginning with a commitment to make a decision. That’s the hard part.”

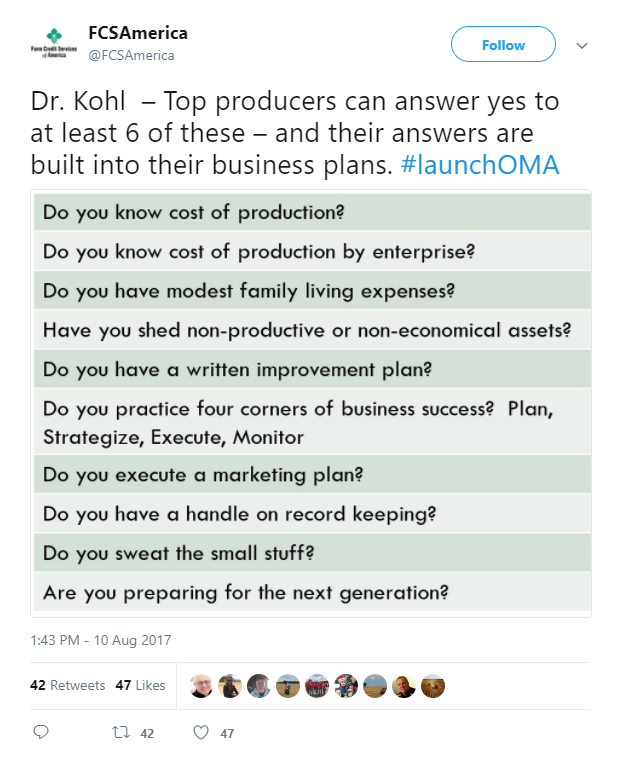

To Plan for Prosperity

“Paralysis by analysis” is an old adage that accurately and humorously describes our inability to make a decision (and act on it) because we never stop considering different options. We might feel like a failure, or inept, if we don’t get the decision right.

In reality, more opportunities are lost from perfect inaction than there are mistakes made from imperfect action.